Turning Your Home Into a Rental: FHA Loan Advice for Moving Out

In this comprehensive guide, we'll explore the nuances of FHA loans that allow you to use rental income to your advantage. Whether you're upsizing, downsizing, or simply relocating, the ability to include rental income in your mortgage application can be a game-changer.

However, this financial strategy comes with specific guidelines and requirements that are crucial to understand. Ready to turn your current home into a stepping stone for your next?

Let's dive into the details and pave the way to your future home.

Key Points

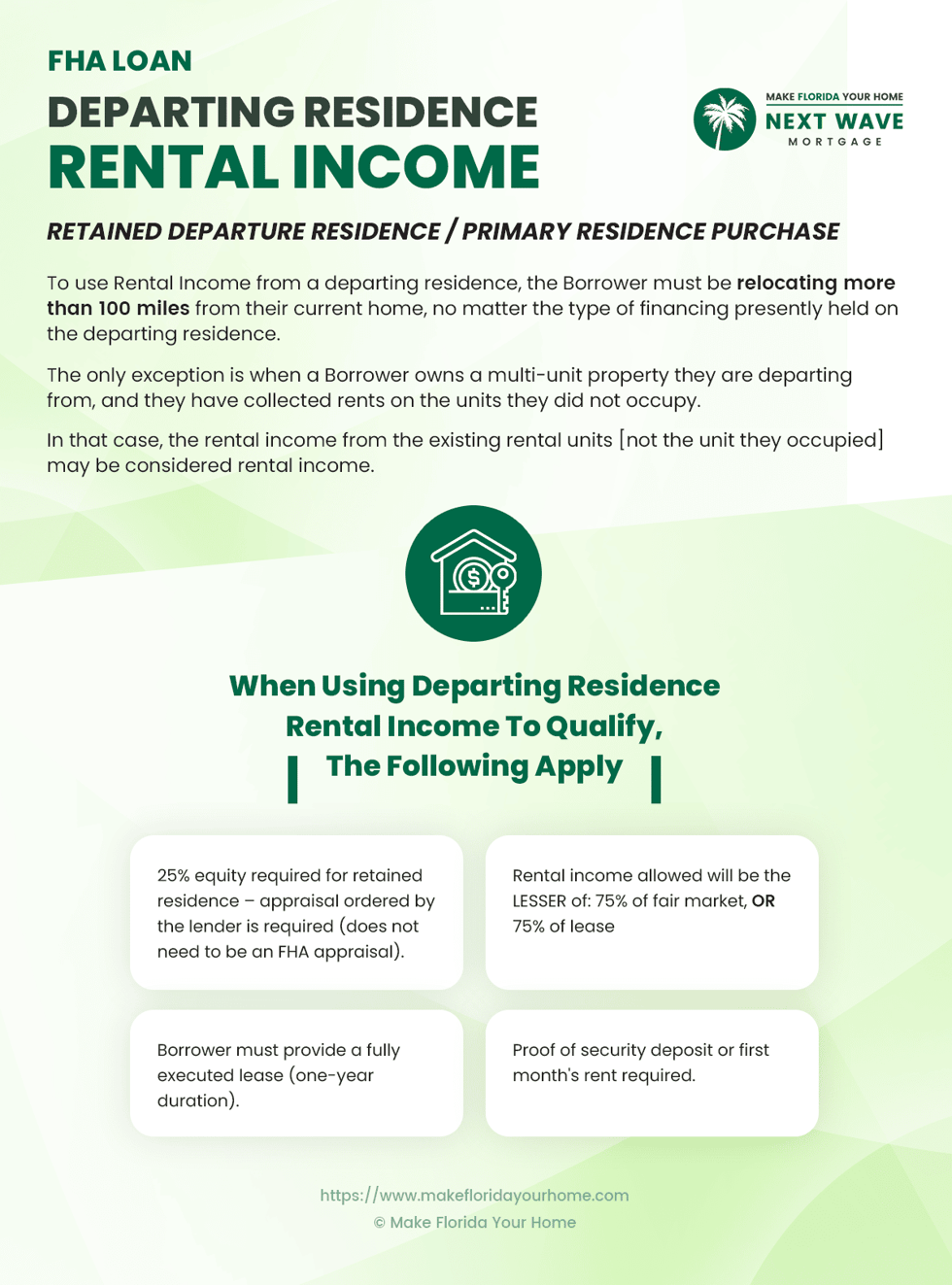

When using rental income from a departing residence to purchase a new home with an FHA loan, there are several key considerations to keep in mind:

-

Relocation Distance: To include rental income in your mortgage application, you typically need to relocate to a home more than 100 miles from your current residence unless you're renting out a multi-unit property you're leaving.

-

Multi-Unit Property Exception: Owners of multi-unit properties may use rental income to qualify for a new mortgage even if the new home is within 100 miles, provided they have experience managing the rental aspects of their current residence.

-

Equity Requirement: You must have at least 25% equity in your departing residence to use its rental income for a new home purchase. This is verified through a professional appraisal.

-

Lease Agreement: A solid, one-year lease agreement is essential to establish the stability and continuity of the rental income you wish to use for mortgage qualification.

-

Rental Income Calculation: Lenders will calculate your qualifying rental income using the lesser of 75% of the property's fair market rent or 75% of the actual lease agreement rent to account for potential vacancies and maintenance costs.

- Security Deposit Verification: Providing proof of your tenant's security deposit or first month's rent is crucial for lenders to acknowledge the rental income as reliable for your mortgage application.

Relocation Distance Requirements

Embarking on the journey to a new home often comes with questions about how your current residence can play a role in your move, particularly if you plan to rent it out.

A key factor in this decision is understanding the 100-mile rule regarding FHA loans.

Simply put, if you want to use the potential rental income from your current home to help qualify for a new mortgage, you generally need to relocate to a place more than 100 miles away from your existing residence.

This distance criterion ensures that there's a legitimate reason for the move, such as a job relocation or a need for a larger home, rather than solely refinancing to benefit from rental income.

The rationale behind this requirement is risk management.

Lenders use this rule to prevent scenarios where a borrower might try to buy a new home with favorable loan terms under the guise of a primary residence purchase, only to turn it into an additional rental property.

The distance requirement helps ensure borrowers intend to use the new property as their primary residence.

Additionally, this rule underscores the significance of a borrower's commitment to their primary residence, as opposed to an investment property.

It's a way for lenders to validate the move's necessity, reinforcing the likelihood that the borrower will continue to maintain both properties responsibly.

In the next sections, we'll delve into other crucial elements, such as the multi-unit property exception and equity requirements, pivotal in how rental income can influence your home-buying process.

The Multi-Unit Property Exception

For many homeowners, renting out their current home can be an attractive way to supplement their income when purchasing a new property.

However, there's a special consideration in the FHA loan guidelines for those who own a multi-unit property, which we call the multi-unit property exception.

While the 100-mile rule is a standard requirement, it doesn't apply to you if you're moving out of a property that contains multiple living units — and you've been renting out at least one.

This exception is in place because you're already acting as a landlord, so the lender can have confidence in your ability to manage a rental property even if your new home is within a 100-mile radius.

For instance, if you own a duplex and have been living in one unit while renting out the other, you can use the income from the existing rental to qualify for a new loan, even if your new home is just a short drive away.

A multi-unit property is typically defined as a residential building divided into multiple housing units. Here are a few examples:

-

Duplexes: Buildings that consist of two separate units, often side by side or stacked.

-

Triplexes: Similar to duplexes, but with three distinct units.

-

Fourplexes: A single building containing four independent residential units.

- Apartment Buildings: While often larger, smaller apartment buildings with four or fewer units can also be considered multi-unit properties for the purpose of an FHA loan.

It's important to note that the rental income you're claiming must come from units you did not occupy. This distinction is crucial because it proves your experience and success in managing rental properties.

Equity Necessities in Your Departing Residence

Equity is a central player when leveraging your current home's rental income for purchasing a new primary residence. But what exactly is equity, and why does it matter in this scenario?

Equity refers to the portion of your property you truly "own." It's the difference between the current market value of your home and the amount you still owe on your mortgage.

For instance, if your home is valued at $300,000 and you owe $225,000 on your mortgage, you have $75,000 in equity.

In using rental income to qualify for a new mortgage, lenders impose an equity requirement to minimize their risk.

They want to ensure you have a significant stake in your departing residence. This is where the FHA loan guideline comes into play, requiring you to have at least 25% equity in your current home.

This substantial amount of equity demonstrates to lenders that you have a buffer, which helps protect their investment in the event of market fluctuations or if you struggle to rent the property.

An appraisal of your current home is necessary to determine if you meet the 25% equity threshold. An appraisal is an unbiased professional opinion of a home's value, typically conducted by a certified or licensed appraiser.

It involves a thorough inspection of the property and a comparison with similar properties recently sold in the vicinity.

The Importance of a Lease Agreement

When securing a mortgage for a new home while counting on rental income from your previous residence, having a lease agreement in place is more than just a formality—it's a requirement that lenders take very seriously.

Lenders typically ask for a lease agreement with a minimum term of one year.

This stipulation assures them of the continuity of your rental income, which becomes a part of your financial profile. A one-year lease reflects stability, which is a crucial factor for lenders when assessing your loan application.

A well-structured lease agreement should protect your interests as a landlord and provide clear terms to your tenant.

Here's what it should include:

-

Tenant Information: Full names and contact information of all tenants.

-

Rental Term: Specify the start and end dates, confirming at least a one-year commitment.

-

Rent Details: Clearly state the monthly rent amount and due dates.

-

Security Deposit: Document the amount of the security deposit and the conditions for its return.

-

Property Description: A detailed description of the rental property and any furnishings or utilities included.

-

Maintenance and Repair Policies: Outline the responsibilities for both landlord and tenant.

- Legal Clauses: Include any local or state-required disclosures or rental regulations.

Rental Income Calculation for Mortgage Qualification

When qualifying for a mortgage with rental income, lenders follow specific guidelines to ensure the income is stable and likely to continue. This process involves a calculation known as the 75% rule.

Lenders will consider the lesser of two amounts: 75% of the fair market rent for your property, as determined by an appraiser, or 75% of the actual rent that your lease agreement states. Why only 75%? This reduction accounts for vacancy losses and ongoing maintenance expenses as a landlord.

Fair market rent estimates what a property would rent for in the open market, reflecting its location, features, and comparable rental properties. The actual lease amount is what your tenant has agreed to pay.

If, for example, the fair market rent for your property is assessed at $1,000 per month, but your lease agreement states a rent of $950, the lender will consider 75% of $950, not $1,000, for your income qualification.

Security Deposit Verification

Lenders are meticulous about the details when using rental income to secure a mortgage for a new home.

One such detail is verifying your tenants' security deposit or the first month's rent. This requirement may seem like an additional step but is important in the mortgage approval process.

The primary reason lenders ask for this proof is to ensure the rental agreement's legitimacy and the rental income's reliability.

By confirming that your tenants have provided a security deposit or paid their first month’s rent, lenders have tangible evidence of the rental arrangement's commencement and the renter's commitment.

This verification acts as a financial buffer that demonstrates your rental income is not just projected but actual.

You must provide clear and verifiable proof of the security deposit or the first month's rent to satisfy your lender's requirements.

Here are some ways to document these transactions effectively:

-

Bank Statements: Showing the deposit of the security or rent payment into your bank account can serve as solid proof. Ensure the statement indicates the source of the deposit with a note or reference to the lease agreement.

-

Receipts: Provide a signed receipt acknowledging the receipt of the tenant's security deposit or first month’s rent.

-

Escrow Account Statements: If the security deposit is held in an escrow account, as some state laws require, the statement from this account can be presented as proof.

- Lease Agreement Annotations: Your lease agreement should have a section where you note the receipt of the security deposit and the first month's rent, which should be initialed by both you and the tenant.

The Bottom Line

Navigating the intricacies of FHA loans and rental income requires a good grasp of the rules and an understanding of how they apply to your situation.

The ability to use rental income from your current home can indeed provide a significant boost to your mortgage qualification, potentially opening up more options when selecting your new home. However, this is not without its requirements and limitations.

The critical takeaways are clear: meet the distance rule or qualify for the multi-unit exception, maintain substantial equity in your departing residence, secure a robust lease agreement, understand the rental income calculation, and provide verifiable proof of tenant commitments.

Each of these elements ensures a smooth process and that lenders view your rental income as a stable and reliable part of your financial picture.

For those looking to make a move, this guide serves as a roadmap to leveraging your existing assets effectively. Remember, while this information provides a foundation, consulting with a mortgage advisor can offer personalized guidance tailored to your financial landscape.

As you embark on this exciting homebuying journey, remember these guidelines to utilize your resources to their fullest potential. With careful planning and informed decisions, your current home can be a stepping stone to your next dream home.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by