The 100-Mile Rule for FHA Loans: Explained

In this blog, we’ll delve into these two aspects of the 100-Mile Rule, helping you understand how they might impact your FHA loan experience.

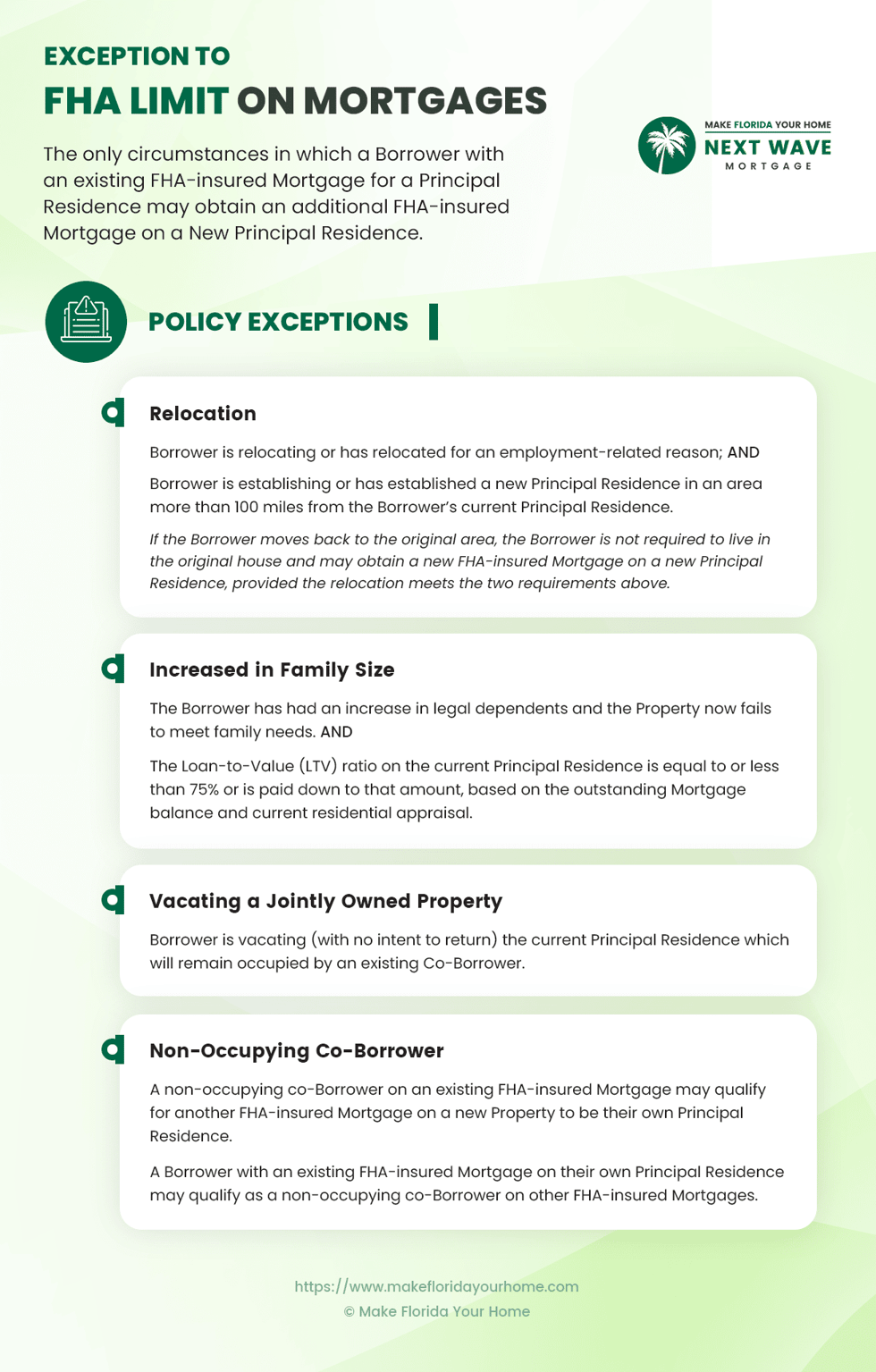

100-Mile Rule for Getting a Second FHA Loan

The first aspect of this rule allows borrowers to hold two FHA loans simultaneously under certain conditions.

The key criterion here is distance: if you're relocating for a job and your new home is over 100 miles away from your current residence, you may qualify to hold another FHA loan.

This provision is particularly useful for those who need to move but aren't ready to sell their existing home.

However, navigating this part of the rule isn't straightforward. It requires substantial proof, such as documentation of your relocation reasons, the distance between the old and new residences, and your plans for the first property.

The complexity lies in providing adequate evidence to meet the FHA's requirements, which can be daunting for many borrowers.

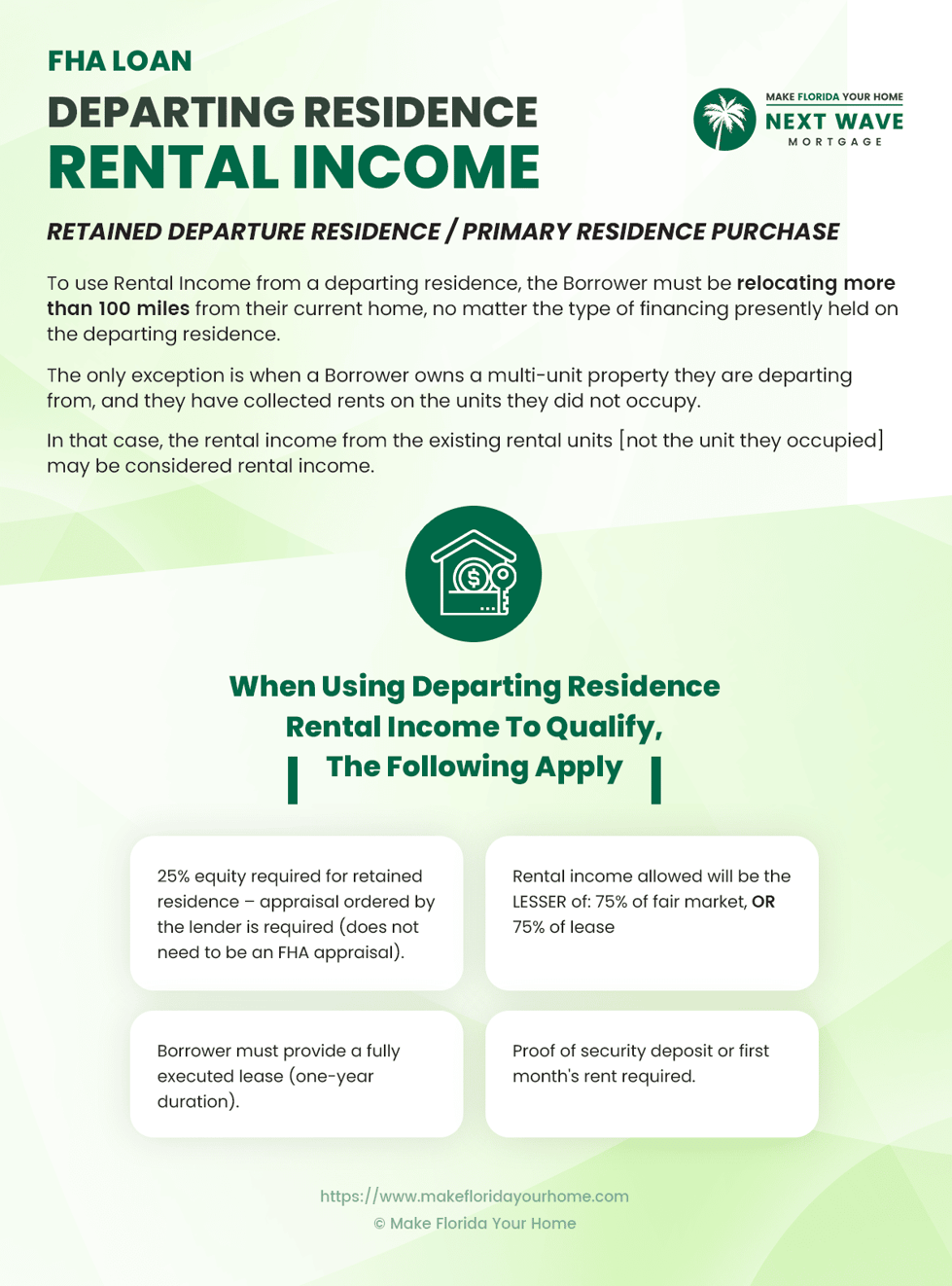

100-Mile Rule For Rental Income

The second part of the 100-Mile Rule pertains to rental income from a departing residence.

Here, the FHA stipulates that if you're moving and planning to rent out your current home, the rental income can only be considered in your new loan qualification if your new home is more than 100 miles away.

This rule is designed to prevent borrowers from using FHA loans to acquire multiple properties for rental purposes without having significant equity in them.

This can pose a significant challenge if you're relocating less than 100 miles away and are depending on the rental income from your previous home to qualify for a new loan.

The restriction aims to maintain the integrity of FHA loans, ensuring they're used primarily for personal residences rather than building a real estate portfolio.

Both aspects of the 100-Mile Rule are intended to prevent the misuse of FHA loans. They ensure these loans serve their primary purpose - helping individuals and families purchase their primary residences.

However, for borrowers who are legitimately relocating and need to manage multiple properties, these rules can add layers of complexity to the loan process.

Understanding and effectively navigating these rules often requires seeking detailed advice from experienced loan officers or housing counselors.

How to Qualify for an FHA Loan

When it comes to securing an FHA loan, there are several important factors to consider. Understanding these can help you determine eligibility and prepare for the application process.

Below, we outline the primary criteria and steps for qualifying for an FHA loan.

Credit Score and Down Payment

FHA loans are known for their more lenient credit requirements than conventional ones.

Typically, borrowers need a minimum credit score of 580 to qualify for the FHA's low down payment advantage, which is currently at 3.5%.

If your credit score is between 500 and 579, you may still qualify, but a larger % down payment of 10% may be required.

Debt-to-Income Ratio (DTI)

Your DTI ratio is another crucial factor. This ratio compares your monthly debt payments to your gross monthly income.

FHA guidelines typically require a DTI ratio of 43% or less, though there are instances where borrowers with higher DTI ratios can be approved, especially with compensating factors.

Mortgage Insurance

With an FHA loan, you must pay for mortgage insurance. This includes an upfront mortgage insurance premium (UFMIP) and an annual premium divided into monthly payments. This insurance protects the lender in case of borrower default.

Employment History and Income Stability

FHA loans require borrowers to have a steady employment history and income. Lenders typically look for a two-year work history, although recent graduates or individuals with a valid reason for employment gaps might still be eligible.

Property Requirements

The property you intend to purchase with an FHA loan must meet certain safety, security, and structural integrity standards. An FHA-approved appraiser must inspect the property to ensure it meets these criteria.

Alternative Loans for Homebuyers Affected by the 100-Mile Rule

The FHA's 100-Mile Rule can present a significant hurdle for many potential homebuyers. However, it's important to remember that this isn't the end of the road. There are several alternative loan options available that can help you achieve your home-buying goals.

Let's delve into some of these alternatives.

Conventional Loans

Conventional loans are a popular alternative to FHA loans. Unlike FHA loans, they are not backed by the government, which means they can have different requirements and more flexibility in certain areas.

For example, conventional loans don't have the same property restrictions as FHA loans, making them a suitable option for those looking to invest in rental properties or buy a second home. However, they usually require a higher credit score and a larger down payment.

VA Loans

A VA loan could be an excellent option if you are a veteran, active-duty service member, or an eligible family member.

VA loans, backed by the Department of Veterans Affairs, often offer favorable terms, such as no down payment and no private mortgage insurance (PMI).

They also don't have a specific rule regarding rental income or owning multiple properties, making them more flexible for those looking to move without selling their current home.

USDA Loans

USDA loans can be an attractive option for homebuyers in rural areas. These loans are backed by the United States Department of Agriculture and are designed to promote homeownership in less densely populated areas.

They offer perks like no down payment and lower mortgage insurance costs. However, they come with specific eligibility requirements related to income and the property's location.

Portfolio Loans

Portfolio loans are non-conforming loans held by a lender's portfolio rather than sold on the secondary market.

These loans can offer more flexibility regarding underwriting standards, making them a good fit for borrowers with unique circumstances, such as real estate investors or those with fluctuating incomes.

However, they often come with higher interest rates and fees.

HELOC or Home Equity Loan

If you already own a home and have built up equity, a home equity line of credit (HELOC) or a home equity loan could provide the funds needed for your new home purchase.

These options allow you to borrow against the equity in your existing property. They can be particularly useful if you eventually plan to sell your current home but need funds.

Non-Qualified Mortgage (Non-QM) Loans

Non-QM loans are designed for borrowers who don't fit the typical lending criteria. These might include self-employed individuals or those with non-traditional income sources.

Non-QM loans can offer more flexible income verification processes but often come with higher interest rates and down payment requirements.

Frequently Asked Questions (FAQs) About FHA Loans and the 100-Mile Rule

To help clarify these topics, we've compiled a list of Frequently Asked Questions (FAQs) that address some of the more nuanced aspects of this rule and its impact on FHA loan borrowers.

Can I rent my current home under the FHA 100-Mile Rule without affecting my new FHA loan?

Yes, you can rent out your current home, but if it's within 100 miles of your new home, the rental income may not be considered in your new FHA loan qualification.

Does the 100-Mile Rule apply when buying a second home as a vacation property?

FHA loans are primarily for primary residences. If you're buying a vacation home, the 100-Mile Rule for having two FHA loans typically doesn't apply, as FHA loans are not intended for vacation properties.

How is the 100-mile distance measured for the rule?

The 100-mile distance is typically measured in a straight line ("as the crow flies") from your current primary residence to the new residence.

What if I relocate for a job less than 100 miles away?

If your job relocation is less than 100 miles away, you might face challenges in qualifying for a second FHA loan, as the 100-mile Rule would generally not apply.

Can I appeal the FHA's decision if I'm denied a loan due to the 100-Mile Rule?

While there isn’t a formal appeal process, you can consult your lender for advice on your situation. They may suggest alternative documentation or loan options.

Are there any specific documentation requirements to prove the necessity of relocation for the 100-Mile Rule?

Yes, you'll need to provide substantial proof, such as a letter from your employer stating the relocation necessity and any other documentation your lender deems necessary.

Does the 100-Mile Rule apply to FHA streamline refinancing?

No, the 100-Mile Rule is primarily concerned with purchasing or acquiring new properties, not refinancing existing ones.

Will this affect my credit score if I'm denied an FHA loan due to the 100-Mile Rule?

The denial of a loan itself does not affect your credit score. However, the credit inquiry made by the lender during the application process might have a minor impact.

Is there a waiting period to reapply for an FHA loan if I'm initially denied due to the 100-Mile Rule?

The FHA mandates no specific waiting period, but lenders may have their own policies. It's best to discuss this with your lender.

Can I use projected rental income from my current home to qualify for an FHA loan on a new property?

Projected rental income can be considered only if the new property is over 100 miles from your current home and if you meet specific lender requirements, including providing a lease agreement and proof of deposit.

The Bottom Line

Navigating the intricacies of the FHA's 100-Mile Rule can be a complex process, but with the right information and guidance, it's manageable.

Whether you're considering holding two FHA loans due to relocation or assessing the impact of rental income on your loan qualification, understanding the specifics of these rules is crucial.

Moreover, being aware of alternative financing options provides a safety net for those who might find the 100-Mile Rule restrictive.

The journey to homeownership, especially under the purview of FHA loans, is filled with unique policies and guidelines.

By arming yourself with knowledge and seeking the assistance of experienced mortgage professionals, you can make informed decisions that align with your homeownership goals and financial situation.

Always remember that each homebuyer's journey is distinct, and exploring all avenues, including FHA loan options and their associated rules, ensures that you find the best path for your individual needs.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by