How You Can Still Get A VA Loan After Chapter 13 Bankruptcy: A Guide

Emerging from Chapter 13 bankruptcy can feel like you're starting a new chapter in your life. But does it mean putting your dream of homeownership on hold?"

While Chapter 13 Bankruptcy presents unique challenges, it doesn't necessarily close the door to securing a VA loan. In fact, understanding the path to eligibility can turn a seemingly daunting process into a manageable journey.

This guide explores how veterans and active military members can navigate the complexities of applying for a VA loan after Chapter 13 Bankruptcy, highlighting the necessary steps, requirements, and tips for success.

With the right approach, obtaining a VA loan is not just a possibility but a viable next step in your journey toward homeownership.

Table of Contents

- Chapter 13 Bankruptcy Explained

- VA Loan Eligibility and Chapter 13 Bankruptcy

- How to Obtain Court Permission for a New Mortgage

- Preparing for a VA Loan Application Post-Bankruptcy

- The Application Process for a VA Loan After Chapter 13 Bankruptcy

- FAQs on VA Loans and Chapter 13 Bankruptcy

- Bottom Line

Chapter 13 Bankruptcy Explained

Filing for Chapter 13 Bankruptcy is often perceived as a financial setback, yet it's also a step towards regaining financial stability.

Unlike Chapter 7, which liquidates your assets, Chapter 13 Bankruptcy allows you to keep your assets while you work on a repayment plan approved by the court.

Chapter 13 Bankruptcy, often known as the wage earner's plan, enables individuals with a regular income to develop a plan to repay all or part of their debts.

Borrowers can propose a repayment plan to pay creditors over three to five years. During this period, creditors cannot start or continue collection efforts.

Differences Between Chapter 13 and Other Types of Bankruptcies

Chapter 7 vs. Chapter 13

Chapter 7 Bankruptcy entails liquidating assets to pay off debts, while Chapter 13 focuses on repaying debts over time, allowing debtors to keep their property.

Eligibility

Chapter 13 requires a regular income and debt within certain limits, whereas Chapter 7 has no income requirement but involves a means test to qualify.

Impact on Credit

Both types affect your credit but in different ways. Chapter 13 remains on your credit report for seven years, whereas Chapter 7 stays for ten years.

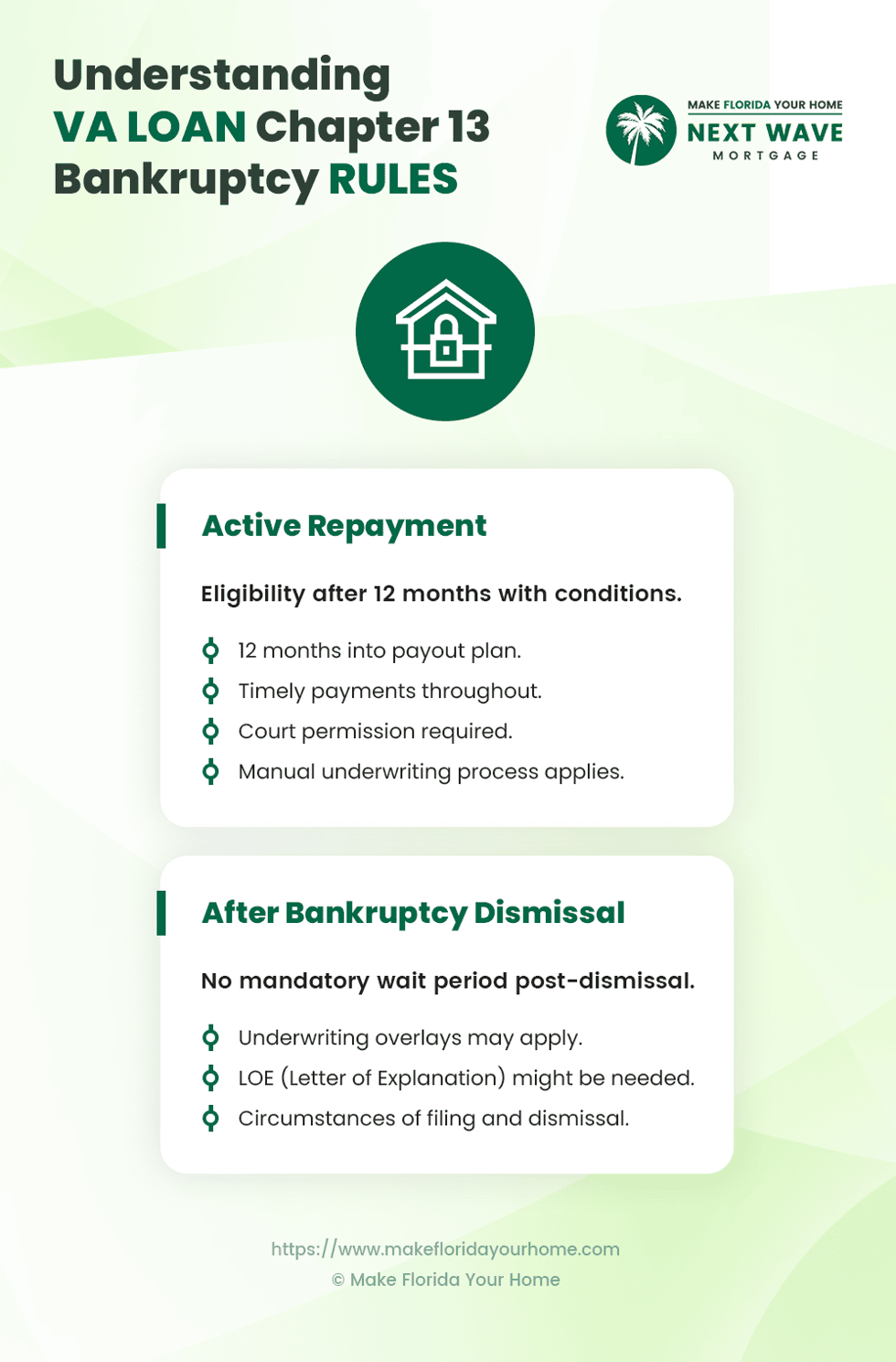

VA Loan Eligibility and Chapter 13 Bankruptcy

Navigating the path to homeownership after filing for Chapter 13 Bankruptcy might seem complex, especially for veterans and active military members looking to take advantage of VA loans.

However, the Department of Veterans Affairs offers guidelines that make this journey more accessible than many realize.

VA loans are known for their flexibility and support for veterans, including those in a Chapter 13 bankruptcy repayment plan.

Key eligibility criteria include:

-

Completion of 12 Months of the Payout Period: Borrowers must have successfully made at least 12 months of consecutive on-time payments as part of their Chapter 13 repayment plan.

- Court Permission: Applicants must obtain permission from the bankruptcy court to incur new debt, which may be granted automatically under certain conditions in some states.

Demonstrating a year of timely payments is crucial for meeting VA eligibility requirements and proving financial responsibility to lenders. This track record can significantly influence a lender's decision to approve a new mortgage application.

Securing court permission is a critical step in the process.

This typically involves a motion filed by your bankruptcy attorney, showing that taking on a new mortgage is not detrimental to your bankruptcy repayment plan. The court's approval signals to lenders that you manage your financial obligations responsibly.

Understanding these requirements is the first step towards securing a VA loan after Chapter 13 Bankruptcy. By adhering to these guidelines, veterans can move closer to achieving homeownership, even amidst financial recovery.

How to Obtain Court Permission for a New Mortgage

One crucial step for veterans and active military members in Chapter 13 Bankruptcy looking to secure a VA loan is obtaining permission from the bankruptcy court. While seeming daunting, this process is an achievable milestone on the path to homeownership.

The Steps to Secure Court Approval

Filing a Motion

Your bankruptcy attorney will file a motion with the bankruptcy court requesting permission for you to incur new debt.

This motion should demonstrate your ability to handle the financial responsibility of a new mortgage without compromising your bankruptcy repayment plan.

Providing Evidence of Financial Stability

Include documentation of your timely payments under the Chapter 13 plan and any other evidence supporting your financial stability and readiness to take on a new mortgage.

Awaiting the Court's Decision

The court will review your motion, considering your payment history and current financial situation. A hearing may be scheduled to discuss your request further.

Successful motions show that the new mortgage will not adversely affect your repayment plan.

Preparing for a VA Loan Application Post-Bankruptcy

After moving through the complexities of Chapter 13 Bankruptcy and securing court permission for new debt, the journey toward homeownership advances to a critical phase: preparing for the VA loan application.

This preparation is crucial in demonstrating to potential lenders your capability and readiness to manage a new mortgage responsibly.

Maintaining timely payments toward your Chapter 13 plan is paramount. This consistency showcases your commitment to financial obligations, laying a foundation of trust with lenders.

Beyond this, rebuilding your credit history is a crucial step. Engaging with secured credit cards or installment loans can significantly mend and enhance your creditworthiness post-bankruptcy when managed wisely.

While VA loans often do not require a down payment, having savings on hand for potential closing costs and other expenses strengthens your loan application and prepares you for the financial responsibilities of homeownership.

The process of gathering necessary documentation also demands attention.

Documents such as proof of timely Chapter 13 payments, court permission for the new mortgage, and income verification become keys to unlocking the door to loan approval.

These documents, alongside any others requested by your lender, paint a comprehensive picture of your financial health and readiness for a new mortgage.

Approaching the application process involves first seeking pre-approval from a lender, which provides insight into your borrowing potential.

Engaging with VA-approved lenders is crucial, as they bring a deep understanding of VA loan requirements, especially for individuals in unique financial situations like post-Chapter 13 Bankruptcy.

Under the guidance of your chosen VA-approved lender, the actual loan application is a detailed process where your financial history and current standing are thoroughly reviewed.

The underwriting phase follows, where the lender verifies your information and assesses your loan repayment capability.

Approval at this stage signals a move towards closing, bringing you closer to homeownership.

This thorough preparation and understanding of the application process underscore the possibility of securing a VA loan post-Chapter 13 Bankruptcy.

It highlights the importance of financial stability and readiness to take on the responsibilities of a new mortgage.

The Application Process for a VA Loan After Chapter 13 Bankruptcy

Securing a VA loan after Chapter 13 Bankruptcy is a process marked by careful preparation and adherence to specific guidelines.

For veterans and active military members ready to take this step, understanding the application process is key to navigating it successfully.

The Initial Steps

The journey begins with obtaining pre-approval from a VA-approved lender.

This early stage involves a preliminary review of your financial situation to determine your loan eligibility and how much you can borrow.

Pre-approval is an invaluable tool in home buying, giving you a clear picture of your budget and demonstrating to sellers that you are a serious buyer.

Choosing the Right Lender

Not all lenders are equipped to handle VA loans, especially in the context of recent Chapter 13 Bankruptcy.

It's crucial to work with a lender who is not only VA-approved but also familiar with the unique aspects of VA loan eligibility for individuals who have undergone bankruptcy.

These lenders can provide tailored advice and support, ensuring your application considers all necessary details and regulations.

Filling Out the Application

With the right lender at your side, the next step is to complete the VA loan application. This process requires detailed financial information, including your income, assets, debts, etc.

Your lender will guide you through the requirements, helping you compile the necessary documentation to support your application, such as proof of timely payments under your Chapter 13 plan and court permission to incur new debt.

Underwriting and Final Approval

Once your application is submitted, it enters the underwriting phase.

During this time, the lender thoroughly examines your financial background and current status to assess your loan repayment ability. This step is critical, as it determines the final approval of your VA loan.

Successful underwriting culminates in loan approval; at this point, you'll proceed to closing—the final step in securing your new home.

Patience and thorough preparation are your best allies throughout the VA loan application process.

By meticulously following each step and working closely with your lender, you can achieve homeownership, a testament to your resilience and financial recovery post-Chapter 13 Bankruptcy.

FAQs on VA Loans and Chapter 13 Bankruptcy

Can I apply for a VA loan while in Chapter 13 Bankruptcy?

Yes, VA loans allow applicants in an active Chapter 13 bankruptcy plan to qualify for a loan, provided they have made at least 12 months of consistent on-time payments and received permission from the bankruptcy court.

Does Chapter 13 Bankruptcy disqualify me from getting a VA loan?

Not necessarily. While Chapter 13 Bankruptcy does impact your credit and financial profile, VA loans are designed to be more forgiving and accessible to veterans.

Following the specific guidelines and demonstrating financial responsibility post-bankruptcy are key to eligibility.

How long after Chapter 13 Bankruptcy can I apply for a VA loan?

You can apply for a VA loan once you have made 12 months of timely payments in your Chapter 13 repayment plan and have court permission to incur new debt.

The actual timing can vary based on individual circumstances and lender requirements.

Will my VA loan application be denied because of my bankruptcy?

Bankruptcy does not automatically lead to a denial.

Lenders will consider various factors, including your credit history since the bankruptcy, current income, and ability to make mortgage payments.

Demonstrating financial stability and responsibility increases your chances of approval.

Bottom Line

The VA loan application process after Chapter 13 Bankruptcy might seem daunting, but it's far from impossible.

Key takeaways include making timely payments during your bankruptcy, obtaining court permission for new debt, and working with a VA-approved lender familiar with post-bankruptcy applications.

These steps prepare you for a successful application and pave the way toward financial recovery and homeownership.

We encourage potential borrowers not to let past financial challenges deter them from exploring their options for homeownership through VA loans.

Professional advice from financial advisors and mortgage specialists can provide personalized guidance and support, helping you understand your eligibility and the best path forward based on your unique situation.

With the right information and support, obtaining a VA loan after Chapter 13 Bankruptcy is an attainable goal, marking a significant milestone in your financial journey and bringing the dream of homeownership within reach.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by