How to Use Non-Qualifying Income to Offset Debt and Qualify for a VA Loan

We'll cover the specific rules regarding military income types, the process of using non-qualifying income, and the impact of seller concessions.

Our goal is to provide a clear and concise understanding of these benefits to maximize the potential of VA loans for homebuyers.

Whether you're a first-time buyer or looking to refinance, this guide will equip you with the essential knowledge to navigate the VA loan process effectively.

Key Points

The most important takeaways from our guide:

-

VA loans accommodate non-qualifying income to offset debt, enhancing eligibility for veterans and active military members by considering a broader spectrum of income types.

-

Military allowances and certain types of pay, including BAS and BAH, can be grossed by 25% to reflect their non-taxable status, increasing the income considered for loan qualification.

-

Non-qualifying income can offset debts of 6-24 months.

- Seller concessions can include paying down or off a buyer's debt.

Understanding Non-Qualifying Income for VA Loans

Non-qualifying income refers to money earned by a borrower that does not meet the traditional criteria set by lenders for loan qualification purposes.

This can include income that is difficult to verify, inconsistent, or does not have a long enough history to satisfy standard lending requirements.

Despite not qualifying for direct loan qualification, the Department of Veterans Affairs (VA) recognizes the value of this income in supporting the borrower's financial situation, especially in the context of VA loans.

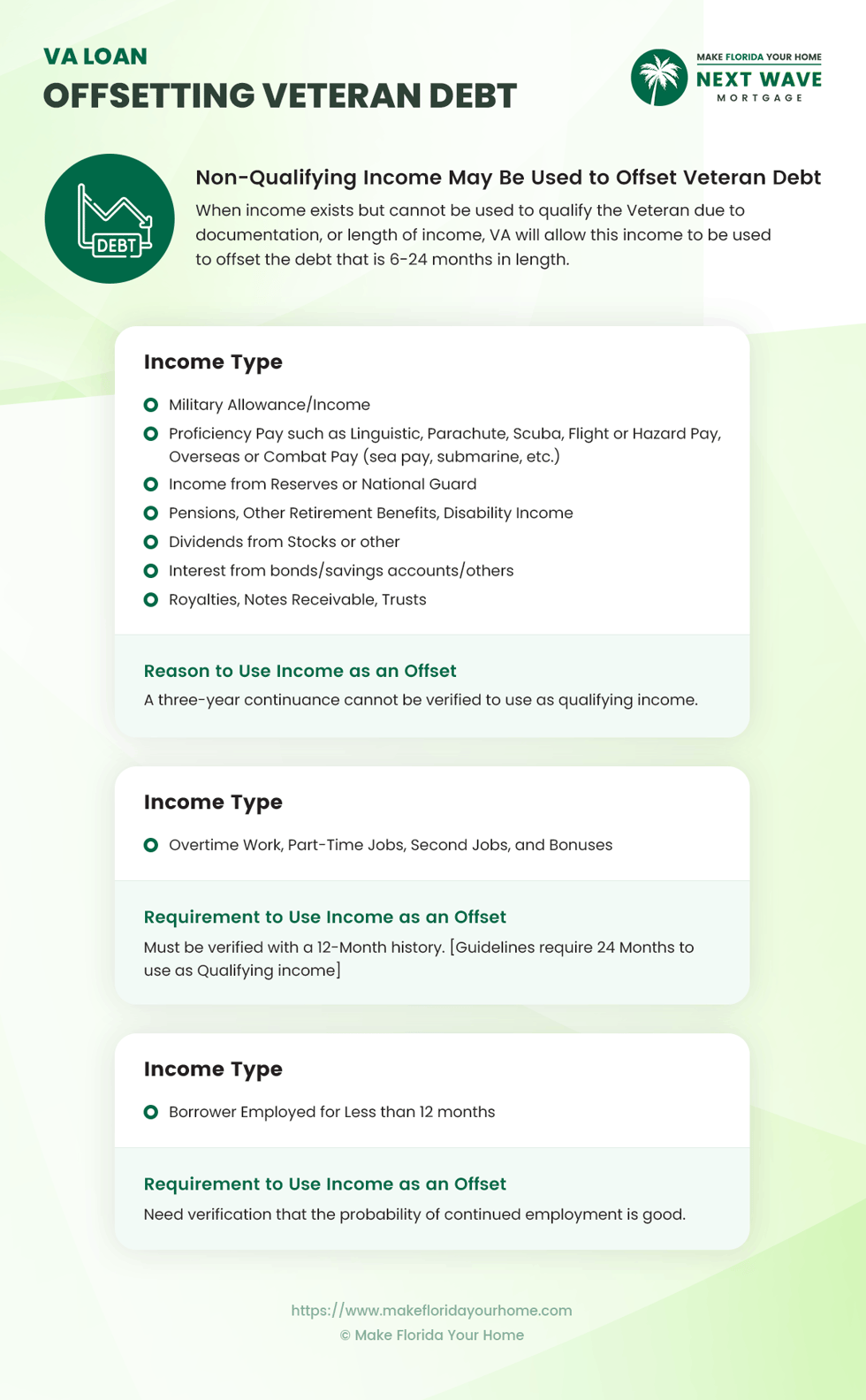

How VA Allows Non-Qualifying Income to Offset Debt

The VA loan program provides a unique approach to handling non-qualifying income, allowing it to affect a veteran's loan application positively. This flexibility is part of what makes VA loans a beneficial choice for many veterans and service members.

Situations Where This May Apply

Non-qualifying income can be especially helpful when a borrower has a reliable source of income that doesn't meet the usual documentation or longevity requirements.

Examples include:

-

Income from a new job or a job with a short history.

-

Income that is seasonal or commission-based, which might fluctuate.

- Benefits or allowances received as part of military service may not continue indefinitely.

In these cases, even though the income does not qualify directly for loan approval, it can still demonstrate financial stability and the ability to manage debt effectively.

Duration of Debts That Can Be Offset (6-24 Months)

One of the key aspects of using non-qualifying income in a VA loan application is its ability to offset debts of specific durations. The VA allows this type of income to offset debts that are 6-24 months in length.

This means if a borrower has outstanding debts that will be paid off or significantly reduced within 6 to 24 months, non-qualifying income can be considered to balance these debts.

This approach helps reduce the debt-to-income ratio, a crucial factor in loan approvals, making it easier for veterans to qualify for a home loan.

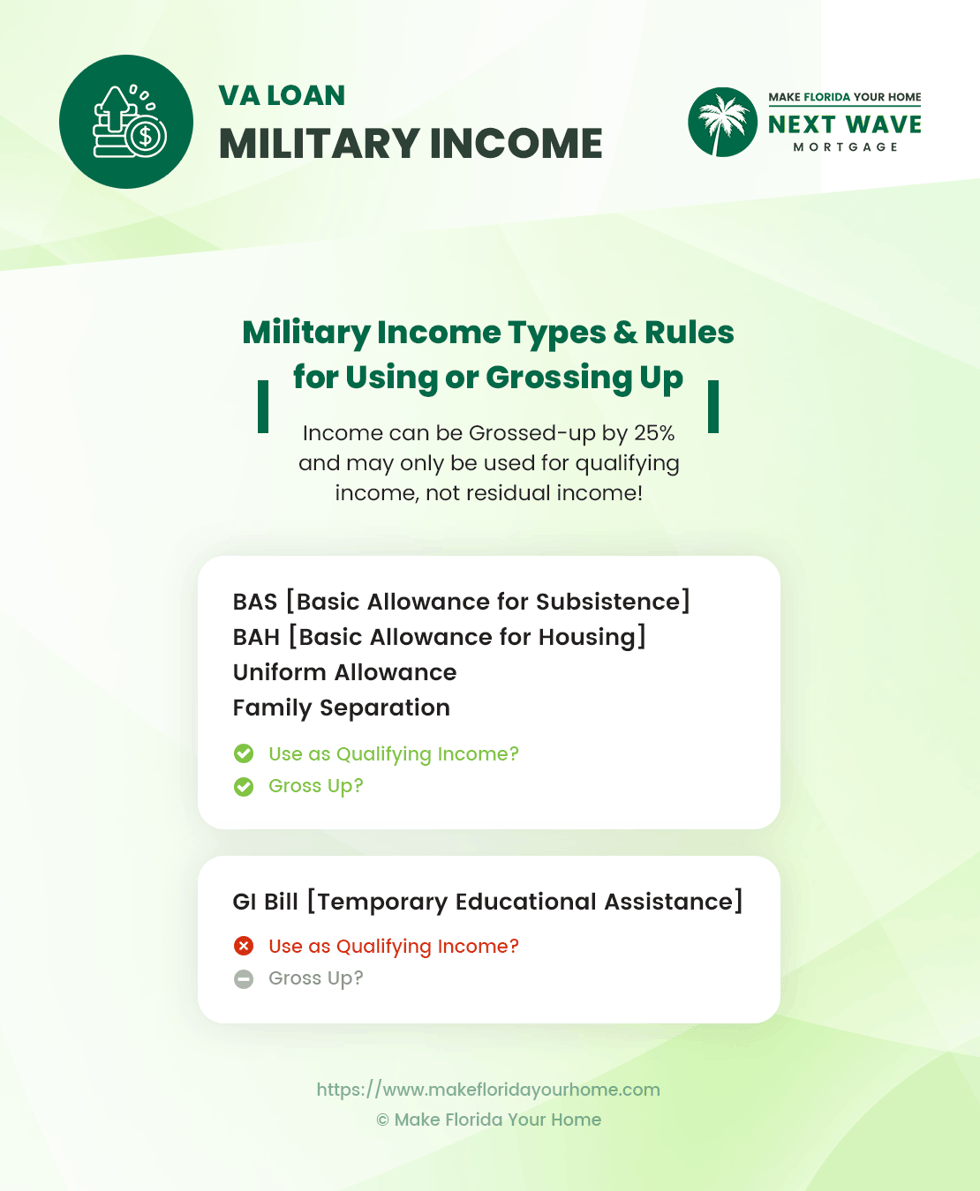

What Types of Military Income Qualify?

The VA recognizes various types of military income when evaluating VA loan applications. This includes allowances and pay that are common to service members, reflecting the unique compensation structure within the military.

Understanding which types of income are considered can significantly impact a veteran's loan application and overall borrowing capacity.

Detailed Rules for Using or Grossing Up Income

The VA allows certain military incomes to be grossed up or used in specific ways to qualify for a loan. Grossing up refers to increasing non-taxable income by a certain percentage (often 25%) to account for the lack of taxes, thereby reflecting a more accurate take-home pay.

Basic Allowance for Subsistence (BAS)

Qualifying: Yes / Gross-Up: Yes (25%)

BAS is a non-taxable allowance intended to offset costs for a service member's meals. When applying for a VA loan, BAS can be grossed by 25%, increasing the income considered for loan qualification.

Basic Allowance for Housing (BAH)

Qualifying: Yes / Gross-Up: Yes (25%)

BAH provides service members with non-taxable income to cover housing expenses. Like BAS, BAH can also be grossed up by 25%, allowing for a higher income calculation on the loan application.

Uniform Allowance

Qualifying: Yes / Gross-Up: Yes (25%)

This allowance is provided to service members for the maintenance and purchase of uniforms. It is considered non-taxable and can be grossed by 25%, contributing to the qualifying income.

Family Separation Pay

Qualifying: Yes / Gross-Up: Yes (25%)

Family Separation Pay is given to service members as compensation for forced family separation due to military orders. This pay is non-taxable and eligible for a 25% gross-up in the loan qualification process.

GI Bill (Temporary Educational Assistance) and its Limitations

Qualifying: No / Gross-Up: N/A

The GI Bill provides educational benefits to veterans, active service members, and their families.

However, it's important to note that income received from the GI Bill, including housing stipends, is not considered qualifying income for a VA loan.

This limitation is due to the temporary and educational-specific nature of this assistance.

Income Types Eligible for Offsetting Veteran Debt

The VA's flexible approach to loan qualification allows various types of income to offset a veteran's debt. This inclusivity supports veterans with diverse financial backgrounds, enhancing their ability to secure home loans.

-

Military Allowance/Income: This includes various military allowances such as BAS, BAH, combat pay, and other special pay. Given their stability and non-taxable nature, these allowances can be effectively used to offset debts.

-

Proficiency Pay: Proficiency pay, such as that for linguistic skills, parachute jumps, scuba diving, flight, or hazard duties, recognizes specialized skills or duties. Due to its specific and often regular nature, it can contribute towards offsetting debts.

-

Income from Reserves or National Guard: While sometimes intermittent, pay received for service in the Reserves or National Guard is considered a reliable source of income that can be used to offset debts, especially when it supplements other income sources.

-

Overtime, Part-Time Jobs, Second Jobs, Bonuses: Income earned outside of a primary job, including overtime pay, earnings from second or part-time jobs, and bonuses, can be used to offset debt if they provide a steady and verifiable income stream.

-

Borrower Employed for Less than 12 Months: For borrowers with less than 12 months of employment history at their current job, their income can still be considered for debt offset if there is a likelihood of continued employment and stability.

-

Pensions, Other Retirement Benefits, Disability Income: Stable and ongoing pensions, retirement benefits, and disability income are reliable income streams that can help offset debt, given their predictable and long-term nature.

- Dividends, Interest, Royalties, Notes Receivable, Trusts: Although variable, income from investments such as dividends, interest payments, royalties, and trusts can be considered for debt offset when they demonstrate consistency and reliability.

Requirements to Verify Each Income Type

For income to be eligible for debt offset, the VA requires clear documentation and verification to ensure its reliability and continuity.

Here are general guidelines for verification:

-

Military Allowance/Income and Proficiency Pay: Documentation from military service records confirms the allowance or pay, amount, and duration.

-

Income from Reserves or National Guard: Orders or service records indicating the schedule of service and associated pay.

-

Overtime, Part-Time Jobs, Second Jobs, Bonuses: Employer verification detailing the frequency, longevity, and amount of such income.

-

Borrower Employed for Less than 12 Months: Employer letter or contract indicating the terms of employment, expected duration, and potential for continued employment.

-

Pensions, Other Retirement Benefits, Disability Income: Official statements or letters from the issuing agency or organization outlining the benefit amount, frequency, and duration.

- Dividends, Interest, Royalties, Notes Receivable, Trusts: Financial statements or records that provide a history of the income, demonstrating its stability and expected continuance.

The thorough verification of these income types ensures they are considered reliable for offsetting debt, providing veterans with a broader spectrum of opportunities to qualify for VA loans.

Seller Concessions and Debt Paydown

Seller concessions are critical in the VA loan process, offering flexibility in negotiations and financial arrangements between buyers and sellers.

These concessions can include closing costs, prepaid fees, or even paying down existing debt to improve the buyer's loan qualification.

The VA's guidelines provide a framework for these concessions, ensuring they are used to benefit the veteran homebuyer without compromising the loan's integrity.

VA's Stance on Seller Paying Down or Off Debt

The VA acknowledges the utility of seller concessions in assisting veterans to close on their homes more efficiently.

Specifically, the VA permits sellers to pay down or completely pay off the buyer's debt as part of the concession agreement.

This flexibility can be particularly advantageous for veterans, allowing them to improve their debt-to-income ratio, a key factor in loan approval.

It's a recognition of the unique financial challenges that veterans may face and an example of the VA's commitment to providing support.

Importance of Underwriting Team Confirmation with RLC

While the VA provides guidelines on seller concessions and debt paydown, confirming with a VA Regional Loan Center (RLC) cannot be overstated.

Each transaction may have unique elements that require clarification or confirmation to ensure compliance with VA regulations.

The underwriting team's role is to verify these details, ensuring that all aspects of the loan, including seller concessions, align with VA standards and ultimately serve the best interest of the veteran homebuyer.

This process underscores the collaborative effort between various parties to secure VA loan benefits, reinforcing the system's integrity and the protection it offers veterans.

Conclusion

Throughout this guide, we've explored the nuances of VA loans, particularly the strategic use of non-qualifying income to offset debt, the eligibility of various types of military income, and the potential for seller concessions to improve loan qualification.

We've clarified how the VA acknowledges a broad spectrum of income sources, including allowances, proficiency pay, and even less traditional income streams, to support veterans in achieving homeownership.

The guide has also highlighted the importance of proper documentation and the specific conditions under which different income types, ranging from 6-24 months, can be considered to offset debts.

Understanding how to use non-qualifying income within the context of a VA loan is more than just a strategy; it's an opportunity to unlock the full potential of VA loan benefits.

This knowledge empowers veterans and active service members, offering them a clearer path to homeownership and financial stability.

By effectively leveraging all available resources, including non-qualifying income and seller concessions, VA loan applicants can enhance their loan approval odds and secure more favorable loan terms.

This guide aims to demystify the process, encouraging veterans to pursue their dream of homeownership with confidence and the support of the VA loan program.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by