When Your FHA Loan Needs Manual Review: Key Reasons Explained

Understanding these key reasons and what triggers a manual review can greatly smooth your path to homeownership. Let's break down these guidelines into simple, easy-to-understand terms.

Table of Contents

- What is FHA Manual Underwriting?

- What Triggers Mandatory Manual Downgrade For an FHA Loan?

- What Credit Score Triggers Manual Underwriting for an FHA Loans?

- Does Non-Traditional Credit Trigger Manual Underwriting for FHA Loans?

- How Having Mortgage Payments In Reserve Can Help During Manual Underwriting

- Special Exceptions and Considerations in FHA Underwriting

- FHA Loan Manual Underwriting: Frequently Asked Questions

- The Bottom Line

What is FHA Manual Underwriting?

Manual underwriting in the context of FHA loans refers to a more personalized review of your loan application. This happens when your financial situation doesn't fit neatly into the standard automated evaluation criteria.

In manual underwriting, a lender closely examines factors like your credit history, income, debts, and compensating factors.

This process ensures that borrowers who might not meet traditional lending criteria still have a fair chance at securing a mortgage.

It's particularly relevant for those with unique financial situations, such as a non-traditional credit history or recent financial setbacks.

Can Manual Underwriting be Better than Automated?

Manual underwriting can be beneficial, especially if your financial situation is unique or complex. It offers a more personalized review of your loan application, which is ideal if the standard automated process doesn't capture the full picture of your financial health.

Suppose you have a lower credit score, a high debt-to-income ratio, or a non-traditional credit history. In that case, manual underwriting might improve your chances of getting a home loan.

It allows underwriters to consider the nuances of your financial situation, potentially leading to loan approval where an automated system might not.

How Long Does Manual Underwriting Take?

The time it takes for manual underwriting in the mortgage process can vary. It might be as quick as a few days, or it could stretch out to several weeks.

This timeline often depends on factors like how much additional information the underwriter needs from you, the current workload of the lender, and how efficient the lender's processes are.

So, while there's no fixed duration, preparing all the necessary documents can help speed up the process.

What Triggers Mandatory Manual Downgrade For an FHA Loan?

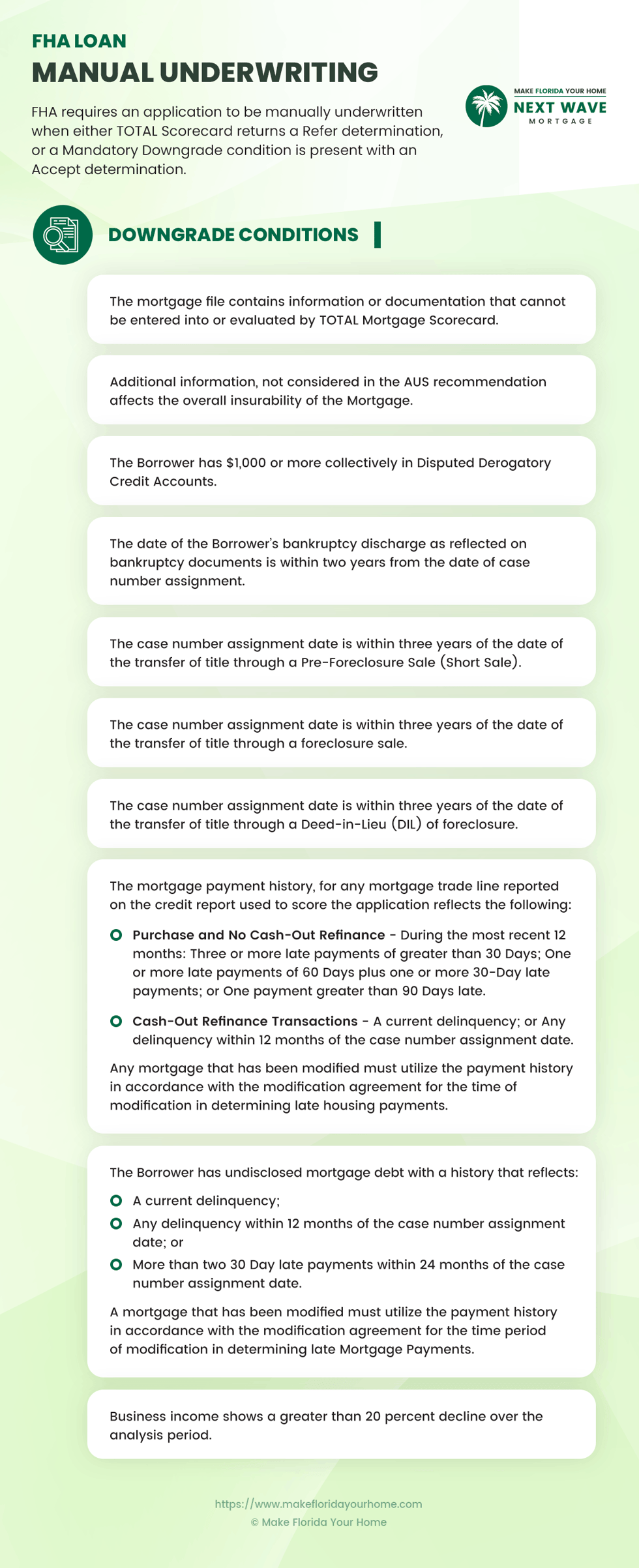

Understanding mandatory manual downgrade conditions is about knowing what triggers a more thorough review of your FHA loan application.

Sometimes, certain factors in your application don't meet the standard automated criteria. When this happens, your loan needs a manual downgrade, meaning a person, not a computer, reviews it in detail.

These triggers include issues like a high debt-to-income ratio, a low credit score, or a history of late payments.

Additionally, you will likely have to go through manual underwriting if any of the following situations apply to you:

-

Disputed Credit Accounts Over $1000: If you're disputing credit accounts that total more than $1000.

-

Recent Bankruptcy: If you've had a bankruptcy discharged in the last two years.

-

Recent Home Loss or Sale Due to Financial Difficulty: If you've gone through a short sale, foreclosure, or similar in the last three years.

-

Late Mortgage Payments Pattern: If you have a history of late payments on your current or past mortgages.

-

Hidden Mortgage Debt: If you have undisclosed mortgage debts with a late payment history.

-

Significant Drop in Business Income: If your business income has recently decreased by more than 20%.

-

Complex Financial Situations: If your loan application includes financial details that the automated system can't assess.

- Other Risk Factors: Any additional risks not evaluated by the automated system.

Each of these factors might lead to a closer examination of your ability to repay the loan. But don't worry; next, we will examine the most common problems triggering manual underwriting and the factors that can ensure your FHA loan is still approved.

What Credit Score Triggers Manual Underwriting for an FHA Loans?

A lower credit score is one of the most common triggers of manual underwriting in FHA loans. Generally, a score of 580 or higher is favorable for standard approval.

However, if your score falls between 500 and 579, you're not out of the race, but your loan application is likely to undergo manual underwriting.

This is where a lender takes a closer look at your financial history, beyond just the credit score. A lower score often means the lender will scrutinize your ability to repay the loan more carefully.

It's important to know that a credit score below 500 usually disqualifies you from an FHA loan. Understanding this helps you gauge where you stand in the loan approval process based on your credit score.

How Your Income Ratio Can Help You Secure an FHA Loan During Manual Underwriting

But don't worry; just because you have a lower credit score doesn't mean securing an FHA loan is impossible. Just as your credit score is a key element in the FHA loan process, so too are your income ratios.

These ratios compare your debt to your income to determine how much of a loan you can comfortably afford.

The FHA generally looks for a debt-to-income ratio (DTI) of 43% or less, which can vary based on your credit score. For instance, you might be allowed a higher DTI ratio if you have a higher credit score.

If your ratios are higher than the standard limits, compensating factors can help balance the scales. These are positive financial aspects that strengthen your loan application.

Common compensating factors include significant cash reserves, a history of making comparable housing payments, or the potential for increased earnings.

These factors can help strengthen your case for loan approval, especially if you're undergoing manual underwriting due to a lower credit score.

Does Non-Traditional Credit Trigger Manual Underwriting for FHA Loans?

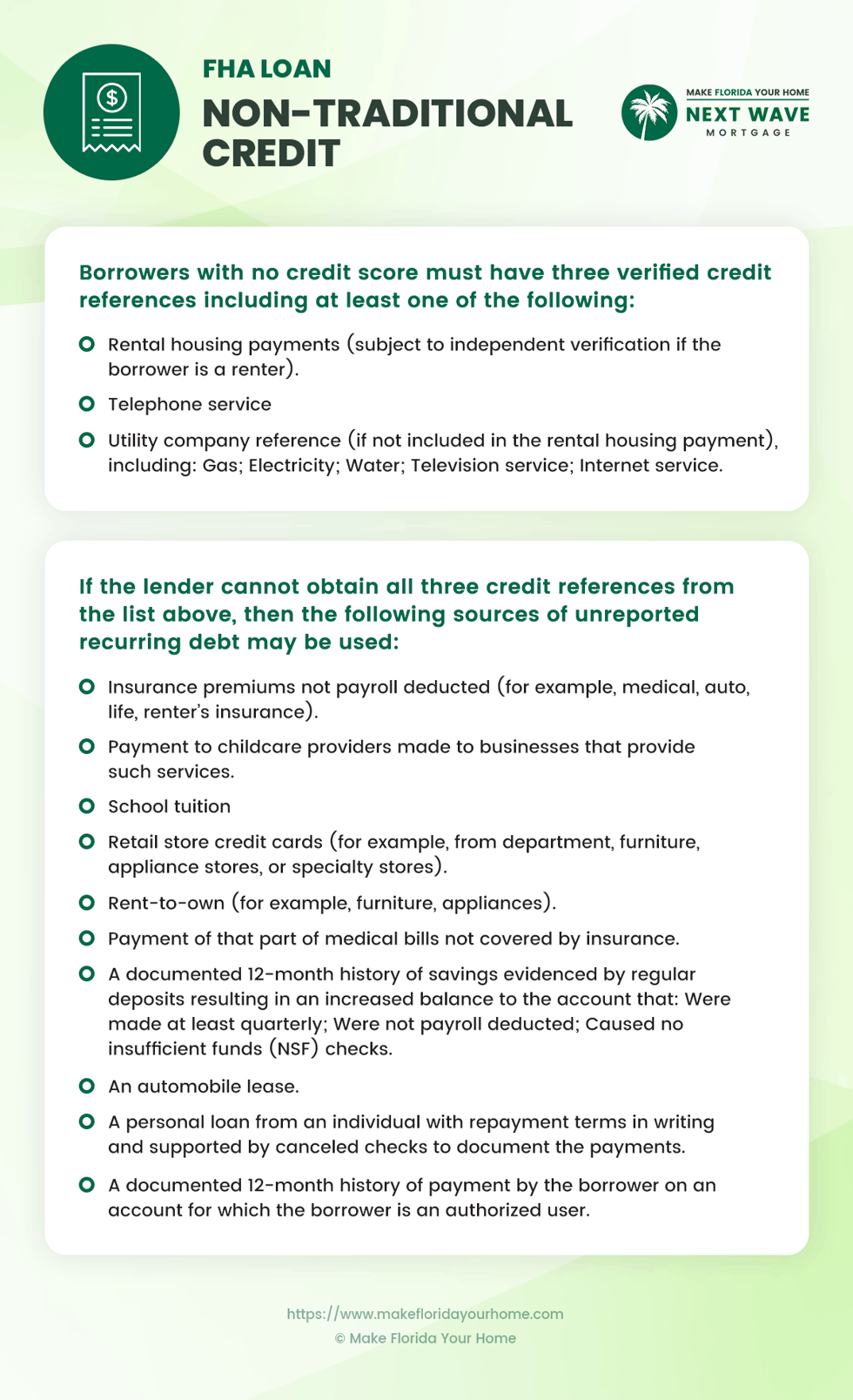

In the FHA loan process, using non-traditional credit can indeed trigger manual underwriting. This is because non-traditional credit doesn't provide the same depth of information as a traditional credit report.

When a borrower lacks a conventional credit history, lenders must manually review other forms of payment history, like rent or utility payments, to assess creditworthiness.

This manual underwriting process gives lenders a more comprehensive view of the borrower's financial habits and responsibilities, even without traditional credit scores.

Using Residual Income as a Compensating Factor

If you have non-traditional credit, residual income can be a significant compensating factor in FHA loans. It's the income left over each month after all debts and living expenses are paid.

This figure is crucial because it shows the lender that you have additional financial cushioning beyond just meeting your monthly debts. Calculating residual income involves subtracting your monthly expenses from your gross monthly income.

A higher residual income can strengthen your loan application, especially if other aspects like credit score or debt-to-income ratio are not as strong.

How Having Mortgage Payments In Reserve Can Help During Manual Underwriting

If your application triggers manual underwriting, meeting reserve requirements can help ensure your application is still accepted, especially for properties with multiple units.

Think of reserves as a safety net of extra money that you have after closing on the house. For a single-family home or a duplex, the FHA often wants to see at least one month's worth of mortgage payments in reserve.

However, buying a property with three or four units typically increases the reserve requirement to three months' worth of mortgage payments.

Not everything counts as reserves. Acceptable reserves usually include savings accounts, certain investments, and sometimes even a portion of retirement accounts.

It's important to know that income you haven't received yet, like an expected bonus or assets that aren't easily turned into cash, like a car, usually don't count towards these requirements.

Special Exceptions and Considerations in FHA Underwriting

FHA underwriting sometimes involves special exceptions and considerations, especially in unique scenarios. For example, military personnel might have different requirements or exceptions due to specific circumstances.

Other special cases could include borrowers with a non-traditional employment history or those who have experienced significant life events that impact their financial status.

In such cases, manual underwriting allows for a more individualized assessment of the borrower's situation, ensuring a fair and comprehensive evaluation of their loan eligibility.

FHA Loan Manual Underwriting: Frequently Asked Questions

When exploring FHA loans and the manual underwriting process, you may have questions about how certain factors affect your loan application.

This FAQ section aims to answer common queries, providing a clearer understanding of the nuances of securing an FHA loan.

Here, we address concerns about credit scores, financial histories, and other key aspects that impact the underwriting process.

Do Underwriters Look at Spending Habits?

Yes, underwriters do look at your spending habits. They will examine your bank statements for regular transfers or payments that could indicate debts or fixed commitments.

Additionally, they'll assess if your spending patterns align with your claimed savings, checking if you consistently spend less than you earn.

This analysis helps them understand your financial stability and ability to manage a mortgage.

What Do FHA Underwriters Look for in Bank Statements?

FHA loan underwriters review your bank statements to determine your mortgage loan eligibility.

They focus on key aspects such as your monthly income, monthly payments, history of expenses, available cash reserves, and the nature of withdrawals.

This examination helps them assess your financial health and readiness for taking on a mortgage loan. They look for consistency in income and reasonable spending patterns that align with your ability to manage a home loan.

What are the compensating factors in FHA loans?

Compensating factors in FHA loans are positive financial aspects that strengthen your loan application, especially if you have a lower credit score or a high debt-to-income ratio.

These factors include a substantial savings reserve, consistent rental payment history, or potential for future earnings.

These aspects help lenders feel more confident about your ability to repay the loan, even if other parts of your application, like your credit score, aren't ideal.

How does non-traditional credit affect FHA loan approval?

Using non-traditional credit for an FHA loan, such as payment histories for rent, utilities, or insurance, can lead to manual underwriting. This is because these types of credit don't provide the same comprehensive view as a traditional credit report.

Lenders will review these alternative credit sources to assess your financial responsibility, ensuring that you can demonstrate your ability to handle credit even without a traditional credit history.

What counts as reserves for an FHA loan?

In an FHA loan context, reserves refer to the funds you have left after closing on your home. These funds act as a financial safety net. Acceptable reserves typically include savings accounts and certain investments.

The required reserve amount varies; for single-family homes, it's often one month's mortgage payment, but it can be higher for multi-unit properties.

Not all assets count as reserves, such as an expected future income or non-liquid assets like cars.

How does bankruptcy affect FHA loan eligibility?

A recent bankruptcy can affect your FHA loan eligibility. If you've had a bankruptcy discharged within the past two years, it often leads to manual underwriting.

This allows the lender to look more deeply at your financial recovery post-bankruptcy. The aim is to assess whether you've regained financial stability and can responsibly manage a mortgage.

What is the importance of residual income in FHA loans?

Residual income is the money you have left each month after paying all debts and living expenses.

A higher residual income can act as a compensating factor in FHA loans, especially if you have a lower credit score or higher debt-to-income ratio.

It demonstrates to lenders that you have financial breathing room, increasing your chances of loan approval.

How do late payments on a mortgage affect FHA loan approval?

Late payments on a mortgage can trigger manual underwriting for an FHA loan. A pattern of late payments indicates potential risk to the lender.

During manual underwriting, the lender will examine the circumstances around these late payments to understand whether they were isolated incidents or part of a recurring pattern impacting your loan approval chances.

Can I get an FHA loan with a low credit score?

Obtaining an FHA loan with a low credit score is possible, but it may require manual underwriting. If your credit score is below the standard threshold (typically 580), lenders will closely examine your financial situation.

This doesn't automatically disqualify you; it means that factors like your income, debts, and payment history will be scrutinized more thoroughly. A lower credit score often leads to a more detailed review to ensure you can responsibly handle the loan.

What special considerations are there for military personnel in FHA underwriting?

Military personnel may encounter special considerations in FHA underwriting. Their unique financial and employment situations, such as frequent relocations or deployment-related income fluctuations, are considered.

This may lead to more flexible criteria or specific exceptions to standard underwriting guidelines, acknowledging the distinct nature of military service.

Can disputed credit accounts affect FHA loan approval?

Yes, disputed credit accounts can affect FHA loan approval. If you have disputed derogatory credit accounts totaling more than $1000, it often leads to manual underwriting.

This allows the lender to examine the nature of the disputes and determine whether they reflect negatively on your overall creditworthiness.

The Bottom Line

Understanding the FHA loan process, especially when it involves manual underwriting, might initially seem a bit tricky.

But getting to know these guidelines makes it a lot easier. Manual underwriting is not a barrier; it's a helpful step for many people to buy their own home, especially when the usual rules don't fit their situation.

This guide has aimed to make clear what causes manual reviews, what you need for them, and special things to consider.

With this knowledge, you're more ready to go through the FHA loan process and get closer to owning your home.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by