How Seller/Builder Concessions in VA Loans Save You Thousands

This unique aspect allows sellers or builders to contribute up to 4% of the sale price towards the buyer's costs, including gifts like appliances, paying off credit balances, or even judgments. However, this 4% does not encompass closing costs, which are calculated separately.

To maximize their benefits while maintaining compliance, veterans must understand these concessions.

In this guide, we will explore Seller/Builder concessions in-depth, helping veterans better understand their VA loan benefits.

Table of Contents

- What Are Seller/Builder Concessions in VA Loans?

- How Seller Concessions Help Your Family: Case Studies and Examples

- Eligibility Criteria for Seller/Builder Concessions

- Comparison with Conventional Loan Concessions

- How to Negotiate Seller/Builder Concessions: Tips and Strategies for Veterans

- FAQs about Seller/Builder Concessions in VA Loans

- The Bottom Line

What Are Seller/Builder Concessions in VA Loans?

Seller/Builder concessions refer to the practice where sellers or builders contribute towards the buyer's costs in a VA loan transaction.

This can include various costs such as appliances, payoff of credit balances, or judgments, enhancing the attractiveness of VA loans for veterans. The concessions are capped at 4% of the loan amount, determined by the VA's final Notice of Value (NOV).

This 4% limit is calculated independently of the buyer's closing costs, specifically allocated for additional benefits outside standard loan closing expenses.

This provision aims to provide financial relief to veteran buyers, allowing them to allocate funds more freely towards other aspects of their home purchase.

What Counts Towards the 4% Limit?

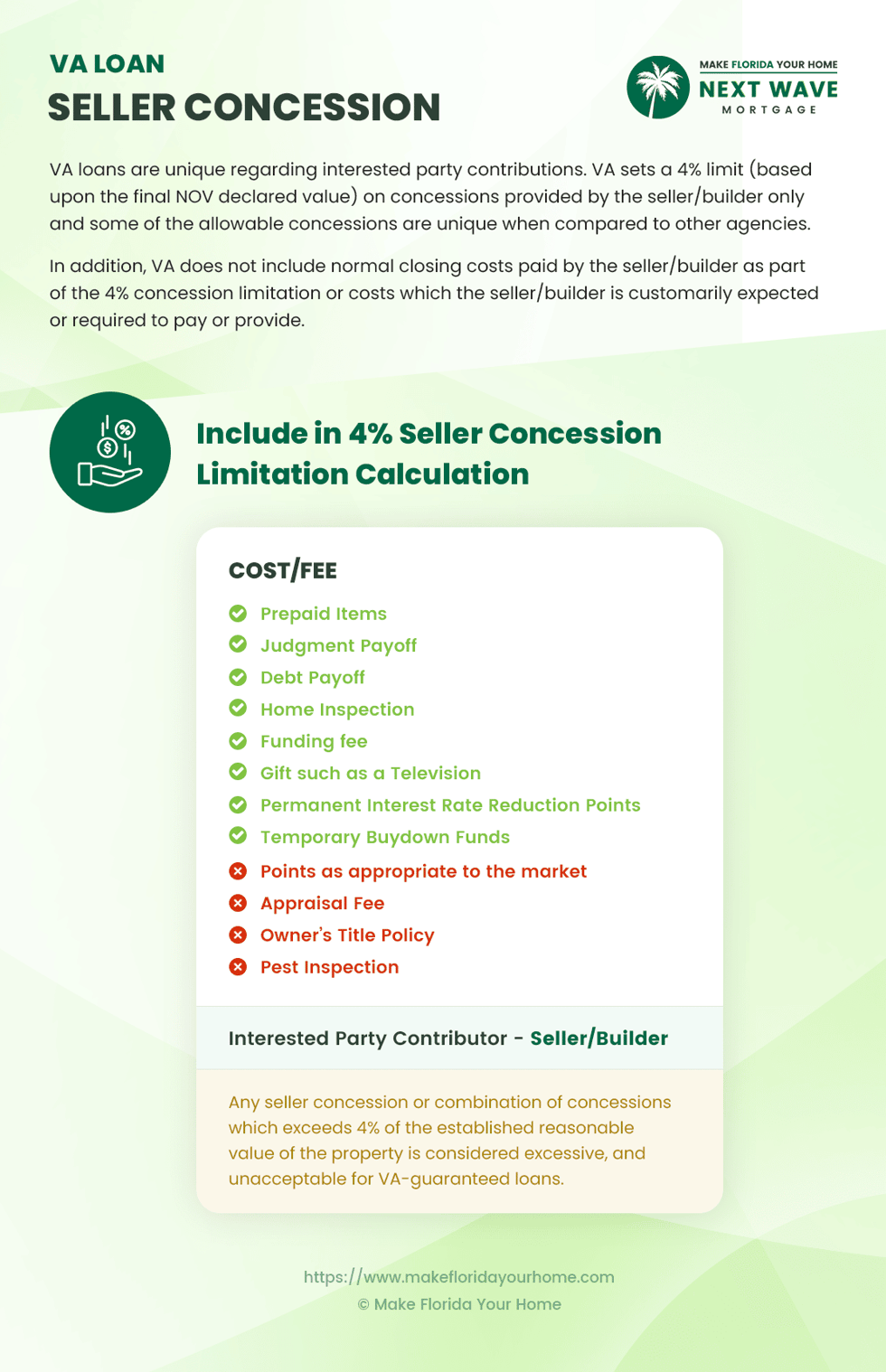

VA loans' 4% concession limit encompasses specific costs and fees that directly benefit the buyer but are outside the usual scope of closing costs.

This limit includes but is not limited to items like funding fees, prepaid items, and payment towards the buyer's debts to facilitate the purchase.

Unique to VA loans, these concessions can also cover personal property items given to the buyer, such as appliances or furniture.

In contrast to traditional loans, VA loans offer a broader selection of concessions, giving veterans greater flexibility and financial assistance during home-buying.

How Seller Concessions Help Your Family: Case Studies and Examples

Let's explore real-world scenarios to truly appreciate the flexibility and benefits of Seller/Builder concessions in VA loans.

These case studies illustrate how concessions can be applied in practical situations, offering significant advantages to veterans in home buying.

From enhancing home value with upgrades to improving financial health by paying off debt, the following examples demonstrate the tangible impact concessions can have on loan terms and buyer benefits.

Appliance Upgrade Scenario

A veteran buying a home is offered a $6,000 appliance upgrade package by the seller as part of the concession.

This enhances the home's value and saves the veteran from out-of-pocket expenses for essential appliances, illustrating how concessions can be tailored to meet the buyer's immediate needs.

Debt Consolidation Example

Another case involves a seller agreeing to use concessions to pay off $5,000 of the buyer's credit card debt.

This strategic use of concessions lowers the buyer's debt-to-income ratio, potentially qualifying them for a better mortgage rate and demonstrating the flexibility of concessions to improve financial stability for the buyer.

Closing Costs and Prepaid Combination

In a different scenario, concessions cover the buyer's closing costs and prepay property taxes and insurance for the first year.

This comprehensive support significantly reduces the initial financial burden on the veteran, showcasing how concessions can cover a wide range of expenses beyond the immediate sale.

Eligibility Criteria for Seller/Builder Concessions

To qualify for Seller/Builder concessions in the context of VA loans, both buyers and sellers must adhere to specific guidelines and requirements set forth by the Department of Veterans Affairs.

For veterans (buyers) to be eligible, they must:

-

Be eligible for VA loan benefits: This typically means they have served in the armed forces for a specific period, as defined by the VA.

-

Obtain a Certificate of Eligibility (COE): This certificate proves the veteran's entitlement to VA loan benefits.

- Meet credit and income requirements: Although VA loans are known for their flexibility, veterans must still meet certain credit scores and income thresholds to qualify for a loan.

Sellers or builders participating in the program must also understand the VA's guidelines, including:

-

Concessions limit: The total value of concessions the seller or builder offers cannot exceed 4% of the loan amount. This is in addition to any other closing costs the seller agrees to pay.

-

Type of concessions allowed: The VA specifies what can be included. These can range from paying off the buyer's debts, providing appliances, or covering prepaid expenses.

- Compliance with VA appraisal: The property must meet or exceed the appraised value determined by a VA-certified appraiser, ensuring the loan amount does not exceed the home's value.

A smooth and compliant transaction depends on both parties understanding these criteria. Veterans interested in using VA loans should consult a VA-approved lender like MakeFloridaYourHome to discuss their situation and eligibility.

Comparison with Conventional Loan Concessions

Seller/Builder concessions play a significant role in home buying, with distinct differences between VA and conventional loans.

Here's a comparative analysis to help veterans understand these differences:

Concession limits

VA loans allow sellers to contribute up to 4% of the loan amount towards the buyer's costs, separate from closing costs.

Conversely, conventional loans have varying concession limits based on the property's down payment amount and occupancy status.

For example, if a buyer puts down less than 10%, the seller's concessions are typically limited to 3% of the purchase price.

Types of costs covered

VA loan concessions can cover many costs, including payment towards the buyer's debts, appliances, and other non-closing items.

Conventional loans are more restrictive, with concessions usually limited to closing costs, prepaid items, and, in some cases, discount points.

Flexibility for buyers

VA loans offer greater flexibility regarding what the concessions can cover, providing veterans with significant financial relief and potential savings.

This is particularly beneficial for veterans facing financial constraints or seeking to minimize out-of-pocket expenses during home-buying.

Impact on loan approval

Large seller concessions can sometimes be viewed negatively for conventional loans, as they may inflate the sale price and affect the loan-to-value ratio (LTV).

With their specific cap and purpose for concessions, VA loans are designed to support the veteran without unduly influencing the loan approval process.

In summary, while both VA and conventional loans offer mechanisms for sellers to assist buyers, VA loans provide a more veteran-friendly framework.

This includes higher concession limits and broader usage, offering veterans a unique advantage in the home-buying process. Understanding these differences can help veterans make informed decisions when comparing loan options.

How to Negotiate Seller/Builder Concessions: Tips and Strategies for Veterans

Navigating the negotiation process for Seller/Builder concessions in a VA loan can significantly impact the affordability and value of your home purchase.

Here are some tips and strategies for veterans to effectively negotiate concessions and common pitfalls to avoid.

Understand the Value of Concessions

You should fully understand how concessions from the seller or builder can benefit you before entering negotiations.

Concessions can cover various costs, including appliances, closing costs, and even debt repayment. By prioritizing your negotiation points, you can get what you need most.

Research the Market

Knowledge of the current real estate market in your desired area can provide leverage in negotiations. If it's a buyer's market, you may have more room to negotiate concessions since sellers might be eager to close the deal.

Conversely, in a seller's market, you may need to be more strategic in your requests.

Prepare Your Finances

Having a clear picture of your financial situation and being pre-approved for a VA loan can strengthen your negotiating position.

Sellers are more likely to consider your requests seriously if they see you as a committed and financially prepared buyer.

Highlight the Benefits to the Seller

When negotiating, it's helpful to frame concessions in a way that also highlights benefits for the seller. For example, offering a faster closing process in exchange for concessions can be attractive to sellers who are eager to sell.

Utilize a Knowledgeable Real Estate Agent

A real estate agent experienced in VA loans can be invaluable during negotiations.

They can advise on what concessions to ask for, how to frame your requests, and how to negotiate on your behalf, using their market knowledge and VA loan processes.

Be Willing to Compromise

While asking for the necessary concessions is important, being flexible and willing to compromise can facilitate negotiations.

Consider what you're willing to give up or lower your expectations on to reach an agreement that benefits both parties.

Common Pitfalls to Avoid

Overreaching

Asking for concessions that far exceed the 4% cap or are unrealistic, given the market conditions, can sour negotiations. Stay informed about what's reasonable to request.

Failing to Prioritize

Not all concessions are equally beneficial. Prioritize your requests based on what will have the most significant impact on your financial situation and home-buying experience.

Neglecting to Get Everything in Writing

Verbal agreements are not binding. Ensure all agreed-upon concessions are clearly documented in the purchase agreement to avoid misunderstandings later.

Overlooking the Appraisal

Remember that the VA loan process includes an appraisal. The home's value must support the purchase price plus any agreed-upon concessions. Ensure your requests do not jeopardize the appraisal outcome.

By following these tips and being mindful of common pitfalls, veterans can effectively negotiate Seller/Builder concessions to enhance the value of their home purchase while ensuring compliance with VA loan guidelines.

FAQs about Seller/Builder Concessions in VA Loans

What are Seller/Builder concessions in VA loans?

Seller/Builder concessions are financial contributions that the seller or builder of a home can offer to the buyer, which can be used to cover various buyer costs in a VA loan transaction.

These concessions include paying off debts, providing appliances, or covering part of the closing costs, capped at 4% of the loan amount.

How do Seller/Builder concessions benefit veterans?

These concessions can significantly reduce veterans' upfront costs when buying a home, allowing for more financial flexibility.

They can cover non-allowable closing costs, offer upgrades to the property, or even help pay off existing debts, making home buying more accessible and affordable for veterans.

Can Seller/Builder concessions cover closing costs?

Yes, but indirectly. While the 4% cap is exclusive of the buyer's closing costs, sellers can still contribute to closing costs separately.

This means the total value of contributions from the seller could exceed 4% if they also agree to pay for closing costs.

What can't be covered by Seller/Builder concessions?

Seller/Builder concessions cannot be used for down payment, and there are limits on paying off debts, judgments, or credit balances that exceed the 4% cap.

They are primarily for costs directly beneficial to the buyer outside of closing costs.

Are there any restrictions on what the concessions can be used for?

Yes, the concessions must be agreed upon and within the 4% cap of the loan amount.

They can be used for various purposes like appliances, paying off credit balances, and even paying for temporary housing if needed, but they cannot be used for the down payment on the home.

How does the 4% cap on concessions compare to conventional loans?

The 4% cap is specific to VA loans and is generally more generous than concession limits on conventional loans, which vary based on the down payment amount and can be lower.

This makes VA loans particularly attractive for veterans.

What happens if the concessions exceed the 4% limit?

Suppose Seller/Builder concessions exceed the 4% cap.

In that case, it may require a reduction in the sale price or a re-negotiation of the terms to ensure compliance with VA loan guidelines, as exceeding this limit could impact loan approval.

Can Seller/Builder concessions be used to pay off the buyer's debts?

Yes, one of the unique benefits of Seller/Builder concessions in a VA loan is the ability to use these funds to pay off the buyer's existing debts, which can help improve the debt-to-income ratio and potentially qualify for a better mortgage rate.

How do I negotiate for Seller/Builder concessions in my VA loan?

Negotiating for concessions involves understanding your needs as a buyer and communicating them clearly to the seller.

Working with a real estate agent or a lender with experience with VA loans is beneficial and can help advocate for your interests during the negotiation.

Do Seller/Builder concessions affect the loan amount?

No, the loan amount is based on the home's purchase price and the VA's approved amount.

However, Seller/Builder concessions can affect the overall financial aspects of the transaction, such as reducing the out-of-pocket expenses for the veteran buyer.

The Bottom Line

When purchasing a home, veterans who want to maximize their VA benefits must understand Seller/Builder concessions.

These concessions can significantly reduce out-of-pocket expenses, provide financial flexibility, and enhance the overall value of the home purchase.

Given the complexities and nuances of VA loan concessions, veterans are encouraged to consult with mortgage professionals like our team at MakeFloridaYourHome.

We can help navigate the specifics of VA loans, ensuring veterans make the most informed decisions and fully leverage the advantages available to them through their service benefits.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by