Maximizing VA Loan Benefits with Rental and Boarder Income: Explained

This guide explains the documentation and eligibility requirements for including rental income in VA loan applications.

By guiding buyers through the financial and governance requirements for success, it aims to help them leverage their real estate for better loan terms.

VA loan users can maximize their benefits and optimize their property investments if they understand these key aspects.

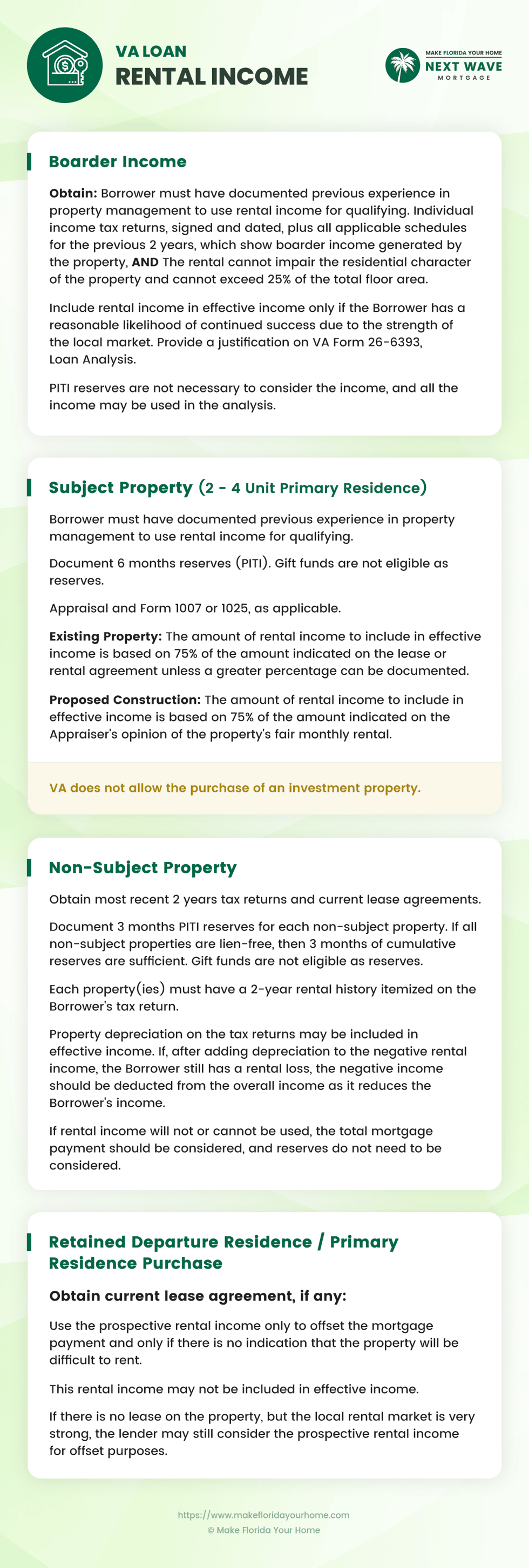

Using Rental Income from 2-4 Unit Properties to Increase Borrowing Power

To acquire or refinance a property with 2-4 units, you should consider leveraging rental income in your loan application.

This section outlines the requirements and processes for effectively using rental income, ensuring you're prepared for a VA loan.

Eligibility Requirements

To qualify for a VA loan on a 2-4 unit property, borrowers must demonstrate a certain level of experience managing properties.

By doing so, the lender ensures that the borrower has the skills and knowledge to manage the property effectively and maintain a steady stream of rental income.

Here are the requirements:

Two-Year History of Landlord Experience

Applicants must show they have successfully managed rental property(ies) for at least two years.

This demonstrates to lenders that the borrower has a proven track record in property management, which is critical for sustaining the rental income contributing to the mortgage payments.

Contract with a Property Manager

For those lacking two-year landlord experience, securing a contract with a professional property manager for at least one year is an acceptable alternative.

This arrangement ensures that the property is under the supervision of an experienced manager, thereby mitigating the risk associated with the borrower's lack of direct experience.

You Also Need Six Months of PITI Reserves

As well as demonstrating experience managing properties, borrowers must demonstrate sufficient financial reserves. The VA requires borrowers to have six months' worth of Principal, Interest, Taxes, and Insurance (PITI) reserves.

These reserves serve as a financial safety net in the event of vacancies or other unforeseen circumstances that may impact rental income.

Exceptions to the Rule

While the VA sets clear guidelines for using rental income, there are exceptions under which the requirements for landlord experience and financial reserves can be waived:

Waiver of Landlord Experience and Reserve Requirements

If the borrower can demonstrate the ability to support the mortgage payment independently of the rental income, then the requirements for a two-year history of landlord experience and six months of PITI reserves may not apply.

This scenario typically occurs when the borrower's income and financial situation are sufficiently robust to cover the mortgage payments without relying on rental income.

Conditions for Support Without Rental Income

The lender will assess the borrower's overall financial health, including income, debt-to-income ratio, and other financial assets, to determine if the mortgage can be comfortably serviced without needing rental income.

This assessment aims to ensure the loan is sustainable for the borrower, even without rental revenue.

Documentation and Verification

Successfully using rental income in your VA loan application requires thorough documentation and verification.

Below is an overview of the necessary documents and a step-by-step guide to compiling and presenting this information:

Required Documents

-

Proof of Landlord Experience: Documentation may include tax returns with reported rental income, lease agreements, and other records demonstrating property management experience.

-

Property Management Contract: If applicable, a signed contract with a property management company outlining the terms of service and duration of the contract.

- Financial Reserves Documentation: Bank statements or other financial documents showing that the borrower has the required six months of PITI in reserves.

Step-by-Step Documentation Guide

-

Compile Landlord Experience Records: Gather all relevant documents demonstrating your experience as a landlord, including tax returns, lease agreements, and any correspondence with tenants that reflects your management activities.

-

Secure a Property Management Contract: If you're using a property management company, ensure the contract is fully executed and reflects at least one year of management services.

-

Document Financial Reserves: Collect recent bank statements or other financial documents showing that you have sufficient reserves. Ensure these documents are dated and clearly show your name and the available balance.

- Prepare for Submission: Organize your documents clearly and logically, preferably with a cover sheet summarizing the contents. This will make it easier for the lender to review and process your application.

By carefully following these guidelines and preparing your documentation, you'll be well-positioned to successfully use rental income from a 2-4 unit property in your VA loan application, opening up new opportunities for property investment and financial growth.

Using Agency Boarder Income to Increase Borrowing Power

Leveraging boarder income can be a strategic way to enhance your VA loan application. This chapter provides a detailed look at how to qualify and document boarder income, ensuring compliance with VA guidelines.

What Is Boarder Income?

Boarder income refers to the money received from renting out part of your primary residence or an entire unit within a multi-unit property you occupy. This income can be considered in your VA loan application, provided it meets specific criteria set by the VA.

Types of Properties Eligible

-

2-4 Unit Primary Residence: If you live in one unit and rent out the others, the income from these rentals can be included in your loan application.

-

1-4 Unit Investment Property: Even if you do not occupy the property, tenant income can be considered if you meet certain conditions.

- Non-Subject Property Retained Departure Residence: If you move out of your primary residence and plan to rent it out, this potential income can also be part of your loan consideration.

Subject vs. Non-Subject Properties

-

Subject Property: The property for which you are applying for a VA loan. Boarder income from this property can directly influence your loan application.

- Non-Subject Property: Any other property you own and may be renting out. Income from these properties is considered differently and has specific reserve requirements.

Qualifying for Boarder Income

The VA requires proof of experience in managing rental properties to use boarder income for qualifying. This ensures that the borrower is capable of maintaining the rental situation effectively.

You Need Individual Income Tax Returns

Applicants must provide individual income tax returns for the previous two years, signed and dated, with all applicable schedules showing the boarder income generated.

This documentation is crucial for verifying the consistency and reliability of the income.

Restrictions on Rental Character

The rented portion of the property must not impair its residential character, nor can it exceed 25% of the total floor area.

This restriction ensures that the primary use of the property remains residential.

Including Rental Income in Effective Income

Rental income can only be included in effective income if there is a reasonable likelihood of continuity. The borrower must provide justification for this continuity on VA Form 26-6393, Loan Analysis.

You Should Show Local Market Strength

The inclusion of rental income also depends on the strength of the local rental market. Borrowers must demonstrate that their rental income is sustainable, given local demand and market conditions.

Reserves and Documentation for Boarder Income

Borrowers must document sufficient reserves, specifically PITI reserves, to cover mortgage payments. This demonstrates financial stability beyond the boarder income. Gift funds are not allowed to be used as reserves for this purpose.

Documentation Requirements

-

Appraisal and Form 1007 or 1025: Depending on the property type, an appraisal is required to establish the rental income viability.

-

Lease Agreements: Current lease agreements must be provided to substantiate the rental income claimed.

- Tax Returns and PITI Reserves: The last two years' tax returns and proof of PITI reserves must be documented, showcasing the borrower's ability to effectively manage and sustain rental income.

Understanding and adhering to these guidelines for agency boarder income can significantly impact your VA loan application.

By thoroughly documenting your boarder income and ensuring it meets VA standards, you can enhance your borrowing power and secure more favorable loan terms.

Additional Considerations for Rental and Boarder Income

Maximizing the benefits of a VA loan includes effectively managing and documenting rental and boarder income.

This chapter delves into additional considerations that borrowers should know when calculating effective income and handling rental scenarios.

Effective Income Calculation

Lenders typically apply a specific formula to calculate effective income from rental and boarder income. Generally, 75% of the gross rental income, as reported on lease agreements or tax returns, is considered.

This adjustment accounts for vacancies and maintenance expenses. The resulting figure is added to your other income sources to determine your total effective income.

Property depreciation, as documented on tax returns, can also affect the calculation of effective income. Depreciation can be added back to your income, potentially increasing the amount of loan you qualify for.

This adjustment is made because depreciation is a non-cash expense that reduces taxable income but not actual cash flow.

Rental History and Lease Agreements

Lenders often require a documented rental income history for the past two years to ensure stable and reliable income. This history helps establish the borrower's experience and success in managing rental properties.

Current lease agreements are essential for documenting the ongoing rental income. These agreements provide lenders with details about the rent amount, lease term, and tenant occupancy, which are critical for calculating effective income.

Prospective rental income can sometimes be used to offset mortgage payments, especially in the case of multi-unit properties where the borrower will occupy one unit and rent out the others.

However, the lender will require evidence of the rental market's strength and potential rental income, which might include a market analysis or an appraiser's opinion.

Handling Properties Without Leases

Lenders may consider prospective rental income in strong rental markets even without current lease agreements.

This consideration is typically based on an appraiser's estimate of the property's fair rental value and evidence of a robust rental demand in the area.

Prospective rental income without a lease is often only used to offset the property's mortgage payment rather than being included in effective income.

This approach helps lenders ensure that borrowers are not overly reliant on uncertain future income to qualify for the loan.

Frequently Asked Questions

Can I use rental income from a property I plan to purchase with a VA loan to qualify for the loan?

Yes, rental income from the property you intend to buy can be used to qualify for a VA loan, provided you meet specific guidelines, including demonstrating potential rental income through a lease agreement or market analysis.

Is there a limit to the number of units a property can have for me to use VA loan benefits?

VA loans allow for the purchase of properties with up to four units, as long as you intend to occupy one of the units as your primary residence.

Can I count income from roommates as boarder income on my VA loan application?

Yes, income from roommates can be considered as boarder income for VA loan qualification, subject to VA guidelines and documentation requirements, such as proving the roommate's history of rent payments.

How does the VA verify the rental or boarder income that I report?

The VA requires documentation such as lease agreements, bank statements showing rent payments, and tax returns to verify reported rental or boarder income.

Can I use future rental income from a multi-unit property to qualify for a larger VA loan?

Future rental income can be considered in your VA loan application, but a realistic appraisal of potential rental income and any existing leases must support it.

Are there any specific requirements for the condition or location of a rental property purchased with a VA loan?

The property must meet the VA’s Minimum Property Requirements (MPRs) for safety, sanitation, and structural integrity, but there are no specific location-based restrictions for rental properties.

What happens if I don’t have a history of being a landlord? Can I still use rental income to qualify?

Suppose you lack a history of property management. In that case, you may still use rental income to qualify by providing a plan to manage the property effectively, such as hiring a property management company.

How long do I need to live in a VA loan-financed property before I can rent it out?

There's no specified duration, but you must intend to occupy the property as your primary residence upon purchase. Later, you can rent it out, adhering to VA loan occupancy requirements.

Can I refinance a VA loan based on increased property value and rental income?

Yes, you can refinance a VA loan to tap into increased property value and adjust your loan terms based on rental income, subject to current VA refinancing guidelines.

If I have multiple properties with rental income, can all the income be considered for a new VA loan?

Yes, income from multiple rental properties can be considered in your VA loan application as long as you provide adequate documentation for each property’s income and comply with VA loan criteria.

Bottom Line

Our guide has walked you through the intricacies of enhancing your VA loan application with rental income and boarder income.

Real estate investments can be leveraged effectively when you understand how to meet eligibility requirements, document incomes and expenses, compute effective income, and manage properties without leases.

Ensure proper rental history and income documentation, understand property depreciation, and navigate the specifics of including this income in your loan application.

If you follow these guidelines, you can maximize the potential of your real estate investments and secure more favorable VA loan terms.

Remember that each lender may have additional requirements or interpretations of the VA guidelines.

When applying for a VA loan, always consult with your loan officer to clarify any uncertainties and make sure that your rental and boarder income is utilized to its fullest extent.

In real estate investing, careful preparation and understanding are crucial for success.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by