A Guide to Getting a Mortgage When Your Job Starts After You Close

With these simple guidelines, borrowers can confidently proceed with their mortgage application even when their employment start date is in the future, with no worries.

Understanding Your Options

Before starting a new job, it's important to understand how different mortgage programs view future income.

Various programs for accepting future employment income for mortgage approval include Fannie Mae, Freddie Mac, FHA, VA, and USDA loans.

Generally, these programs require future employment income to be documented in a non-contingent offer letter or employment contract that specifies the position, start date, and salary.

In addition, borrowers must demonstrate that they have the savings or other liquid assets to cover their mortgage and other living expenses until their employment begins.

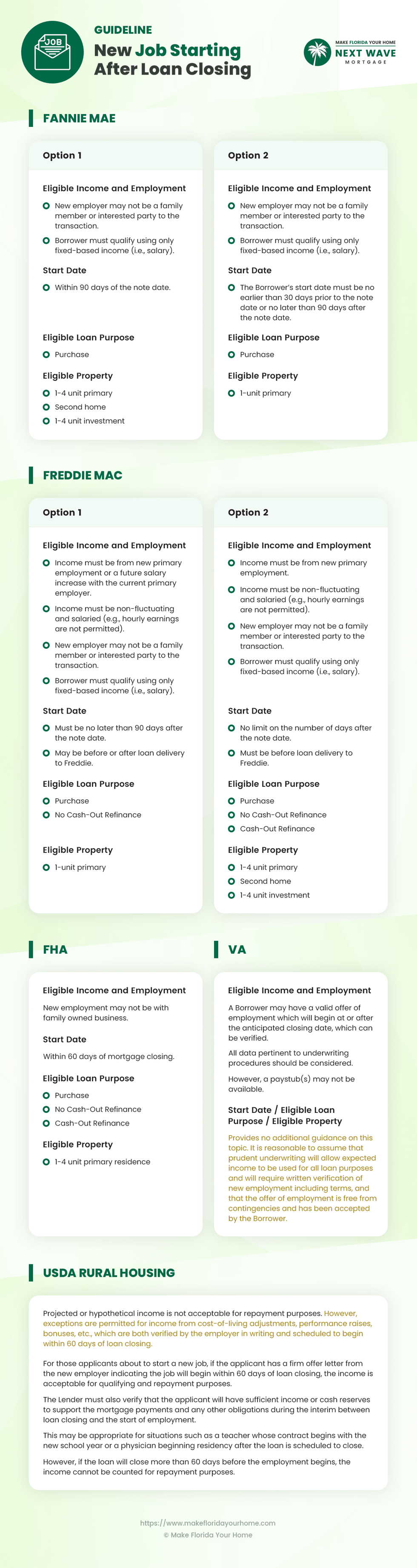

Program-Specific Rules

Navigating the requirements for mortgage approval with future employment income necessitates a deep dive into the guidelines of various mortgage programs.

Each program has its set of rules concerning eligible income and employment, start dates, loan purposes, property types, and verification processes.

Conventional Mortgages

Fannie Mae and Freddie Mac require the borrower's future income from a non-family member or non-interested party to ensure impartiality in the employment offer.

The income considered must be fixed-based, such as a salary, to ensure stability and predictability in repayment capacity.

The start date for new employment must fall within a specific window relative to the note date.

For both entities, the employment should commence no later than 90 days after the mortgage closing. This stipulation ensures borrowers have a stable income stream shortly after acquiring their home.

These programs cater to a wide range of loan purposes, including purchase, no cash-out refinance, and, in some cases, cash-out refinance.

They cover various property types, from 1-4 unit primary residences to second homes and even 1-4 unit investment properties, providing flexibility to borrowers with future income.

To bridge the gap between closing and the start of employment, borrowers must demonstrate sufficient reserves.

The exact requirements can vary, but documentation of additional funds to cover several months of mortgage payments and other liabilities is generally necessary.

FHA Loans

The FHA allows for the inclusion of future income if a verifiable employment offer starts within 60 days post-closing. The income must be non-fluctuating and salaried, ensuring consistent payments toward the mortgage.

Applicants must have enough reserves to cover their mortgage and other financial obligations until the start of their employment.

This may involve a detailed examination of the borrower's financial situation to ensure they can sustain themselves in the interim.

VA Loans

The VA program is somewhat lenient regarding verifying future income, often not requiring immediate proof of income if the job starts within a reasonable timeframe from the loan closing.

This flexibility aids veterans in transitioning into new roles without undue financial pressure.

VA loans are known for their flexibility, allowing for various types of loans and properties. This includes purchases and refinances for 1-4 unit primary residences, with no stringent limitations on property types, which benefits veterans looking to settle in new homes.

USDA Loans

Specifically designed for rural homebuyers, the USDA Rural Housing program allows future income to be considered under certain conditions.

The focus is on providing opportunities for those moving to rural areas, requiring non-fluctuating, salaried income to ensure loan repayment capability.

For all these programs, thorough employment and income verification is a cornerstone of the approval process.

This includes examining offer letters, employment contracts, and in some cases, additional documentation to confirm the borrower's ability to fulfill their loan obligations.

Understanding these program-specific guidelines is vital for prospective borrowers looking to navigate the mortgage application process with future employment.

Documentation Needed When Your Job Starts After Your Loan Closes

Offer Letters

An offer letter from your future employer is paramount. This letter should detail the terms of your employment, including your position, salary, and start date.

For mortgage purposes, the offer must be non-contingent, meaning your employment is guaranteed and not dependent on certain conditions being met.

Employment Contracts

Similar to offer letters, employment contracts provide a legally binding agreement between you and your future employer.

These documents are more detailed, covering job responsibilities, compensation structure, and other employment terms.

Verification of Employment Terms

Beyond the initial offer letter or contract, lenders may require further verification of your employment terms.

This could involve direct communication with your future employer to confirm the details of your employment offer.

Your Lender May Have Additional Unique Requirements

In addition to the standard guidelines set by mortgage programs, lenders or financial institutions may impose investor overlays.

Overlays can affect the documentation process and qualification criteria, making understanding any additional demands from your lender crucial.

Investors might require more stringent income verification, such as a pay stub from the new job (even before you start) or confirmation from the employer that the job offer remains valid.

In addition to higher credit score requirements, borrowers might have to prove they have additional reserves to cover their mortgage payments during the transition period.

FAQs about Qualifying for a Mortgage with Future Employment

Can I qualify for a mortgage if my job hasn't started yet?

Yes, you can qualify for a mortgage with future employment.

Lenders will consider an offer letter or employment contract as proof of income, provided the job starts within a specific timeframe (usually within 60-90 days of closing).

The offer must be non-contingent, and you may need to show sufficient reserves to cover the mortgage payments until your start date.

What documentation will I need to provide to verify future employment?

To verify future employment, you'll typically need to provide an offer letter or employment contract that outlines your position, salary, and start date.

Some lenders may also require direct verification from your future employer or additional documentation showing that all employment contingencies have been met.

How do investor overlays affect my mortgage application?

Investor overlays are additional criteria lenders impose that go beyond the standard requirements of mortgage programs.

These can affect your application by requiring higher credit scores, larger reserves, or more stringent income verification.

Understanding a lender's overlays is essential, as they can vary significantly.

Can I use income from a job that starts more than 90 days after closing?

This largely depends on the lender and the specific mortgage program.

While most programs require your job to start within 60-90 days of closing, some lenders might have overlays that allow for more extended periods, especially if you can demonstrate sufficient reserves to cover the interim.

What happens if my employment start date is delayed after I've been approved for a mortgage?

If your employment start date is delayed, notify your lender immediately.

The lender may require updated documentation or reassess your financial situation to ensure you can still afford the mortgage payments.

In some cases, this might lead to a delay in closing or the need for additional reserves.

Are there any mortgage programs that do not accept future employment income?

Most major mortgage programs, including those offered by Fannie Mae, Freddie Mac, FHA, VA, and USDA, accept future employment income under specific conditions.

However, individual lender overlays can restrict this acceptance, so checking with your lender is crucial.

Do all lenders require the same documentation for future employment?

No, documentation requirements can vary between lenders due to investor overlays.

While the basic requirements (like offer letters or employment contracts) are consistent across programs, some lenders may ask for additional verification or impose stricter guidelines.

Can future income be used for all types of mortgage loans?

Future income is generally accepted for purchase loans, and no cash-out refinances across most mortgage programs.

However, the acceptance of future income for cash-out refinances may vary by lender and program, with some imposing stricter criteria or not allowing it at all.

What if my future job is with a family-owned business?

Jobs with family-owned businesses are scrutinized more closely due to potential conflicts of interest. You'll need to provide thorough documentation proving the legitimacy of the employment offer and salary.

Some programs may not allow this type of income, or it might be subject to investor overlays.

How can I ensure my mortgage application is successful when using future employment income?

To ensure success, provide all required documentation promptly, including a comprehensive offer letter or employment contract.

Maintain open communication with your lender, especially if there are any changes to your employment situation.

It's also wise to consult a mortgage advisor to navigate program-specific guidelines and investor overlays effectively.

Bottom Line

Each program has unique income and employment eligibility requirements, start dates, loan purposes, property types, and documentation to bridge the gap between closing and employment start.

It is also crucial to understand investor overlays, since they can greatly affect your qualification criteria and the documentation process.

With the insights provided, borrowers can confidently approach their mortgage application, regardless of their employment start date.

Get the personalized assistance and expert advice you need to secure a home loan with future employment by contacting MakeFloridaYourHome.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by