The $25,000 Down Payment Toward Equity Act in 2025: Updated

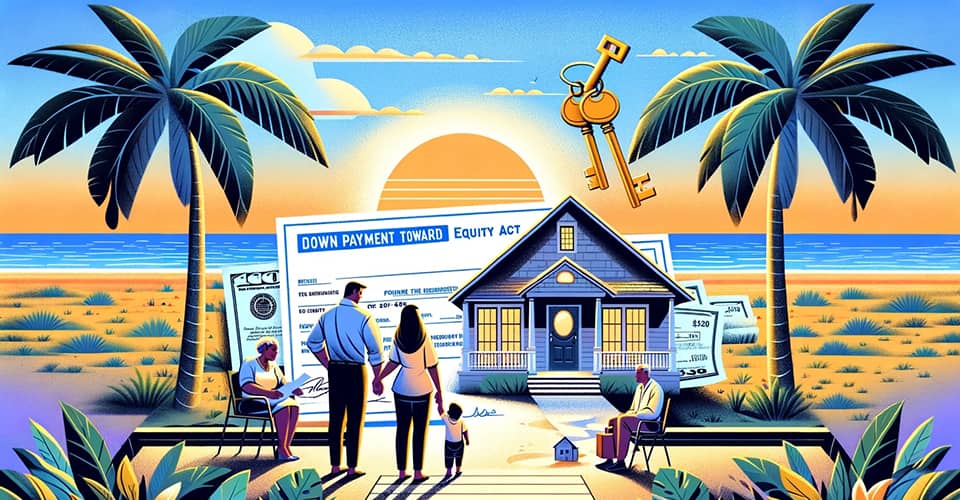

The Down Payment Toward Equity Act, introduced during the Biden administration, represents a transformative approach aimed at reducing barriers to homeownership.

This legislation proposes up to $25,000 in financial assistance for first-time, first-generation home buyers, targeting low- and moderate-income households to cover upfront costs such as down payments and closing costs.

The Act's significance in the current housing market cannot be overstated; it seeks to address the widening homeownership gap, especially among socially and economically disadvantaged groups, including racial minorities and individuals with disabilities.

Table of Contents

- What is the Down Payment Toward Equity Act?

- Eligibility Criteria for the $25,000 Grant

- What Is The Status of The Program in Mid-2024?

- When Is Biden's Grant Projected to Pass and the $25,000 Expected to Become Available?

- Alternatives to the $25,000 Down Payment Grant

- Frequently Asked Questions (FAQs)

- What's Next?

What is the Down Payment Toward Equity Act?

The Down Payment Toward Equity Act is a legislative proposal aimed at providing substantial financial support to first-time and first-generation home buyers.

This act proposes up to $25,000 in assistance to help cover the costs associated with purchasing a home, such as down payments, closing costs, and mortgage interest rate reductions.

The primary objective of the act is to make homeownership more accessible to low- and moderate-income individuals, as well as to address racial disparities in homeownership rates.

The program emphasizes support for "socially disadvantaged individuals," aiming to reduce economic barriers to homeownership for historically underserved communities.

Eligibility Criteria for the $25,000 Grant

To be eligible for the $25,000 grant under the Down Payment Toward Equity Act, applicants must meet several key criteria designed to ensure the program benefits first-time, low- to moderate-income home buyers, particularly those from disadvantaged backgrounds.

These criteria include:

First-Time Home Buyer Status

Applicants must not have owned a home or co-signed on a mortgage in the past three years. This includes those who have previously owned a home but not within the last three years, making them eligible as first-time buyers once again.

Income Limits

Eligibility is restricted to individuals with household incomes at or below 120% of the area median income (AMI) for most areas.

However, for high-cost areas, applicants can qualify with incomes up to 180% of the AMI, making the program accessible to a broader range of potential buyers in expensive markets.

Primary Residence Requirement

The program mandates that the purchased property must be the primary residence of the applicant. This excludes vacation homes, investment properties, or second homes from eligibility.

First-Generation Home Buyer

Priority is given to applicants who are first-generation home buyers, meaning their parents or legal guardians have not owned a home during the applicant's lifetime. This requirement is waived for applicants who have lived in foster care.

Use of Government-Backed Mortgages

Applicants must secure a mortgage that is backed by government agencies such as Fannie Mae, Freddie Mac, FHA, VA, or USDA. These mortgages offer more accessible terms for first-time buyers, including lower down payments.

Educational Course Completion

To qualify, applicants must complete a HUD-approved homebuyer education course. These courses are designed to prepare first-time buyers for the responsibilities of homeownership and can often be completed online.

What Is The Status of The Program in Mid-2024?

As of mid-2024, the Down Payment Toward Equity Act remains in legislative limbo, still under consideration by the 2023-2024 Congress.

Despite its introduction and several key milestones since 2021, the bill has yet to be passed into law. Until the bill is officially passed and becomes law, potential beneficiaries cannot claim the $25,000 grant.

In the meantime, those looking into homeownership might consider the variety of grants and programs that MakeFloridaYourHome provides, like the Florida Hometown Heroes $35,000 grant.

When Is Biden's Grant Projected to Pass and the $25,000 Expected to Become Available?

Based on the legislative timeline and progress of the Down Payment Toward Equity Act as of mid-2024, it's challenging to pinpoint an exact date when the $25,000 grant will become available.

The bill has been through various stages of introduction and discussion in Congress since 2021, with the latest version introduced in March 2024.

Legislative processes, especially for bills involving significant financial allocations like this one, can be lengthy and complex, involving multiple steps of approval and potential revisions.

Given the historical pace of similar legislative efforts and the importance of coordination across multiple government agencies to implement the grant program, it's plausible that the earliest the bill could pass would be sometime after mid-2024.

Prospective home buyers interested in this grant are advised to stay updated on the bill's progress through official legislative tracking platforms and news from reputable sources like MakeFloridaYourHome.

Alternatives to the $25,000 Down Payment Grant

For those looking for alternatives to the Down Payment Toward Equity Act's $25,000 grant, there are several other programs designed to assist first-time homebuyers and community heroes with the purchase of their primary residence.

Here's a summary of three notable programs:

Florida Hometown Heroes Program

This program targets first-time homebuyers who are actively working or serving in their Florida communities, offering up to $35,000 in assistance for down payments and closing costs.

Key benefits include a lower first mortgage interest rate and no requirement for monthly mortgage insurance premiums for those who choose FHA loans.

Eligibility criteria include being a first-time homebuyer employed in a qualifying profession within the community, meeting specific income limits, and having a minimum credit score of 620.

FHA Loan Program

The Federal Housing Administration backs the FHA loan program, which is particularly beneficial for first-time homebuyers.

It requires a minimum down payment of just 3.5% and accommodates buyers with lower credit scores than those typically required for conventional loans.

The program also offers more lenient debt-to-income ratios, making it easier for applicants to qualify for a loan.

Additionally, FHA loans can provide lower interest rates, helping to reduce both upfront costs and monthly mortgage payments.

Good Neighbor Next Door (GNND) Program

Operated by the U.S. Department of Housing and Urban Development, the GNND Program aims to encourage community revitalization through homeownership.

It offers a 50% discount on the list price of homes in designated revitalization areas to eligible teachers, law enforcement officers, firefighters, and emergency medical technicians. Participants must commit to living in the home for at least 36 months as their primary residence.

This program not only supports personal homeownership goals but also contributes to the strengthening of communities.

Each of these programs offers unique benefits and eligibility requirements, catering to a range of potential homebuyers.

They represent valuable resources for those seeking assistance in purchasing a home, providing financial aid and incentives beyond what is available through the Down Payment Toward Equity Act.

Frequently Asked Questions (FAQs)

Navigating the complexities of home buying and understanding the Down Payment Toward Equity Act can be challenging.

This FAQ section aims to address some of the most common questions and provide clear, concise answers to help you on your journey to homeownership.

Who is eligible for the Down Payment Toward Equity Act?

Eligibility is primarily for first-time and first-generation homebuyers who meet certain income requirements.

This includes individuals who have not owned a home in the past three years, those who are buying a home in a community where they work or serve, and people who meet specific income limits based on the area median income.

What is the purpose of the Down Payment Toward Equity Act?

The Act aims to make homeownership more accessible to low- and moderate-income individuals by providing up to $25,000 in assistance for down payments and closing costs.

It targets reducing the homeownership gap, especially among historically underserved communities.

How much assistance can I receive from the program?

Eligible homebuyers can receive up to $25,000 in assistance, which can be used for down payments, closing costs, and other expenses associated with purchasing a home.

When will the Down Payment Toward Equity Act become available?

As of mid-2024, the Act is still under consideration by Congress and has not yet become law. The timeline for when it might pass and become available is uncertain.

Are there alternatives to the Down Payment Toward Equity Act?

Yes, there are several alternatives, including the Florida Hometown Heroes Program, FHA Loan Program, and the Good Neighbor Next Door (GNND) Program, each offering unique benefits for homebuyers.

What are the key benefits of the Florida Hometown Heroes Program?

This program offers up to $35,000 in assistance for first-time, income-qualified homebuyers in Florida, providing support for down payments and closing costs, along with a lower first mortgage interest rate and no PMI for FHA loans.

How do FHA loans work?

FHA loans require a lower minimum down payment (as low as 3.5%) and are accessible to buyers with lower credit scores than conventional loans, making them a suitable option for first-time homebuyers.

What is the Good Neighbor Next Door Program?

The GNND Program offers a 50% discount on homes in designated revitalization areas to eligible public servants, such as teachers and law enforcement officers, promoting community revitalization through homeownership.

Can I use the $25,000 grant for any home purchase?

The grant is specifically intended for the purchase of a primary residence and cannot be used for second homes or investment properties. The home must also meet other program-specific eligibility criteria.

How do I apply for the Down Payment Toward Equity Act or its alternatives?

Application processes vary by program. For the Down Payment Toward Equity Act, details will become clearer once the bill becomes law.

For alternative programs like the FHA Loan Program or the GNND Program, prospective homebuyers should contact approved lenders or HUD for application details.

What's Next?

As the journey to homeownership unfolds, especially with opportunities like the Down Payment Toward Equity Act and its alternatives, it's essential to stay informed and seek expert guidance.

MakeFloridaYourHome is a valuable ally in this process, offering insights and support tailored to your home-buying aspirations.

With the right resources and advice, navigating the path to homeownership can become more straightforward and attainable.

Remember, reaching your goal of owning a home is within reach, and expert guidance can make all the difference.

With over 50 years of mortgage industry experience, we are here to help you achieve the American dream of owning a home. We strive to provide the best education before, during, and after you buy a home. Our advice is based on experience with Phil Ganz and Team closing over One billion dollars and helping countless families.

About Author - Phil Ganz

Phil Ganz has over 20+ years of experience in the residential financing space. With over a billion dollars of funded loans, Phil helps homebuyers configure the perfect mortgage plan. Whether it's your first home, a complex multiple-property purchase, or anything in between, Phil has the experience to help you achieve your goals.

By

By  Edited by

Edited by